Author: Rafael Wolf | Libertarian Candidate, Michigan House of Representatives

Editor: TBD

Do you like corporate bailouts and Ponzi schemes? What about pension taxes? What about politicians constantly dunking on you without you ever knowing it? If so then you’ll just love the America you live in! If not…well then…here we go!

President Biden’s Build Back Better Bill kicks many cans down the road that continue propping up Ponzi schemes with bailouts. One quite large can and Ponzi I noticed when thumbing through the almost 500 page Build Back Better document was on about page 194. There we see something called the “Pension Benefit Guaranty Corporation” (PBGC).

What is that you might be asking?

The PBGC is a federally chartered corporation from a bill passed in 1974. The purpose of this corporation is to:

- encourage the continuation and maintenance of voluntary private defined benefit pension plans

- provide timely and uninterrupted payment of pension benefits

- keep pension insurance premiums at the lowest level necessary to carry out its operations

PBGC: ( http://bit.ly/3iu3vB9 )

Do you happen know that The United States of America is a “business model” more than it is a country?

The United States is run like a business at the behest of business leaders who fund politicians that employ attorneys who convince courts to enforce opinions with police state enforcers or the military.

^ the above is important to know and to understand. Get that tattooed on your back!

The Federal Government has a lot of Federally chartered “corporations”, as do states. One of the more disgusting federal corporations is UNICOR, they have the privilege of converting prisoners into cheap captured labor where pay ranges from $0.23 cents to $1.15 per hour. Are you familiar with the MEDC in Michigan? Do you know what MEDC stands for? Michigan Economic Development Corporation!

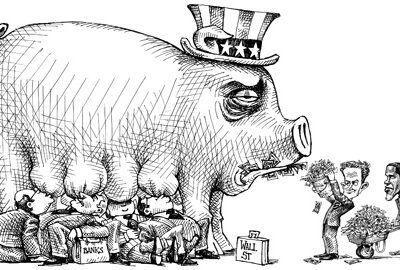

The wide reaching systems I have briefly described are designed, usually on behalf of a small group of elites, to make money, protect wealth while minimizing LIABILITY. There are a number of descriptions for what these systems are. It is a version of the old “in with the good, out with the bad”. Some think and describe this as socialism for the rich, capitalism for the poor. Many also throughout the world call this plain old “capitalism”. If you are a bit more learned you might call it crony capitalism, corrupt capitalism, a good ole boy network, and other unkind pejoratives like “a f*cked up mess”. Capitalism in this context is not a description of your local hard working boot strapped entrepreneur but rather, a much larger system of interests at the top as I have described made up of individuals with business interests and a pecking order of sorts who also have varying interests and differing amounts of power. These groups of individuals have a vested interest to dump liability onto the public balance sheet in any number of ways. This keeps it off of their ledger of profit and loss thus, they benefit handsomely with higher margins at lower risks for their investments.

The Bailout:

You begin to then see that the PBGC is designed as a “corporation” to shift the liability of failed investment growth in the fund onto the public non-pensioner tax payer in the form of public debt and public responsibility. You know, the majority of people not in that club benefiting from said pension schemes. Non-pension workers are paying a large percentage of pension workers retirements. Pensions are available to union and non-union labor, you simply have to work for a company that offers a pension. For example, some hospitals employ non-union workers that still offer these workers pensions.

If this is the first time you have heard this notion…stick with me; eyes wide open!

Notice the description of the PBGC: “encourage the continuation and maintenance of voluntary private defined benefit pension plans”. Now notice the phrase, “…private defined benefit pension plans”. You would assume then that “private” does not mean “public” but this pension plan is more public than it is private. The only private aspect is, as George Carlin once said, that “you ain’t in it”.

As of 2018 there were 4,919 pension plans under management, and PBGC paid $5.8 billion in benefits to 861,000 retirees in those plans. According to a White House Press Release, on December 8th, 2022, the Build Back Better will “protect” the pensions of 350,000 individuals rather than see the recipients of those pensions see a 60% reduction in benefits. A White House press release states that…

“Prior to the America Rescue Plan, the PBGC’s multiemployer pension insurance program was projected to become insolvent in 2026.” ( http://bit.ly/3k3NEd0 )

Build Back Better is a framework that includes The American Rescue Plan and the two are one of a kind. You also read that correctly. “PROJECTED TO BECOME INSOLVENT IN 2026”. We should all be asking questions like…how and why would it become insolvent? How is it that the White House will be protecting 350,000 individuals exactly? Who’s expense does this come at? Oh, at the expense of tens of millions of non-pension tax payers? Oh, okay, wait…what?

In fact, we should be asking a lot of questions like why a privately funded retirement program is now being commingled with public funds. What you have here are more tax payer bailouts racking up national debt at interest because these liabilities are put onto the credit card by borrowing money at interest. That is how it works. This is the only solution both democratic and republican “leaders” have. The solution is running up debt to prevent pain with more bailouts burying it in 500 page bills nobody will read who votes.

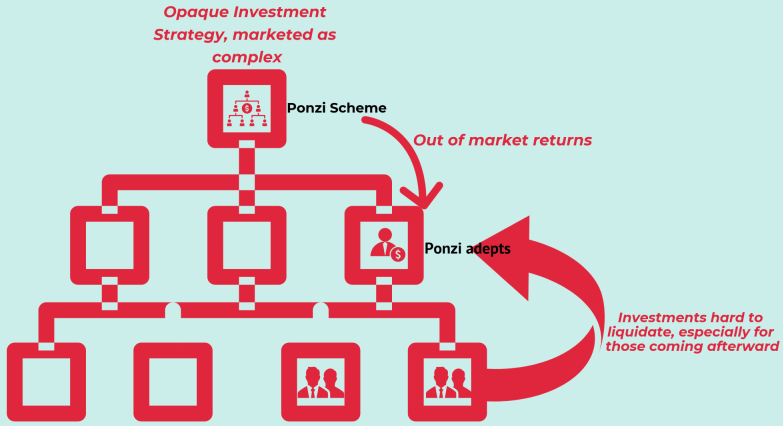

This “corporation” is a typical government Ponzi scheme ( http://bit.ly/3GROJ0e ) investing in the stock market, private equity firms, US bonds, money market funds, international bonds, and REITs (Real Estate Investment Trusts). REITs invest in “income-producing real estate”. This is another important thing to understand, is it producing stuff or income? Notice, “income-producing“.

The truth about the PBGC is, if you put a dollar into the pension fund, that tomorrow, as a result of inflation, monetary debasement and the erosion of dollar buying power or malinvestment by fund managers, you actually have less money. This is especially true with a stock market in steep decline or during times of economic crisis.

The PBGC is a Ponzi because the payment liability over time can not keep up with the obligations originally promised to “investors”. The “investors” are the workers contributing to the fund. The fund needs “new investment” from new investors but pension rolls are not increasing because pensions are no longer a favored investment vehicle pushed by most companies. This type of scheme, which is a Ponzi, will ultimately collapse if allowed and as it was about to by 2026. Who then can your gold standard politicians you continually elect into office get as new investors, especially one’s who don’t expect a return or who might not even know they are investing in a real stinker? You know, the types of people that Ponzi, Madoff, and Sam Bankman-Fried looked for in their schemes…suckers! Wait…I know, I have the perfect pool of dopey unaware suckers! The public! The public who are more interested in sports, video games, posting nonsense on social media, alcohol consumption, or the many other more angelic distractions one has in modern America. The ruling class can get 60% more investment from non-pension workers who pay taxes to maintain the promised amounts to these workers! Genius! We can simply launder it into 30+ trillion dollars in national debt at interest. It would seem then that the PBGC is another “too big to fail” institution like the banks and insurance companies in 2008 who’s liabilities are moved over into the part of the ledger where the national debt resides. It is right up there on the ledger with PPP loans that got converted into “grants” or forgiven. Nobody seems to be highlighting the failures of this system or how this Ponzi continues operating. Nobody is hiding it. It is all out in the open but sigh, few see it or can comprehend it.

Why is the fund failing?

There are many reasons for this fund to fail but one interesting thing that caught my eye which seems to tie many of the themes I often discuss together rather well is an investment vehicle called a REIT. We must remember that under the current duopoly regime that The United States is actually a Banana Republic run by corporate interests. It is not a democracy, constitutional republic or anything of the sorts. Remember when I said that The United States:

…is run like a business at the behest of business leaders who fund politicians that employ attorneys who convince courts to enforce opinions…

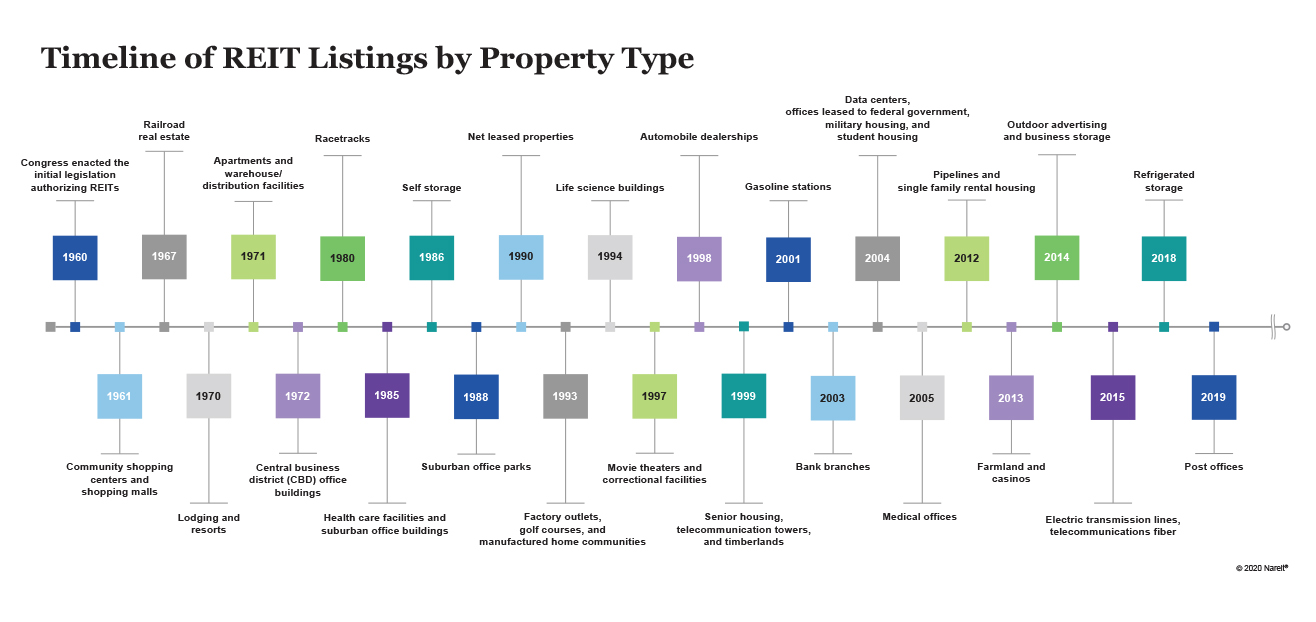

REITs, one of the investment vehicles of the PBGC sticks out in their investment portfolio to me so I looked into it. REITs were legislated into existence in 1960 under President Eisenhower as part of the Cigar Excise Tax Extension, an Act that merged aspects of the stock market into real estate essentially turning real estate into the Wonder Twins of investment equities with shares, like a stock on the stock market ( http://bit.ly/3ZqXN3q ). A real investment with super powers!

Many REITs are in fact publicly traded and listed on public exchanges. Guess what the first REIT was in 1961? Community shopping centers and malls! ( http://bit.ly/3ikzcgl ). This is where things begin making sense from a wider historical perspective.

When reading about legislation such as Build Back Better or The American Rescue Plan most media simply report on the now, not the then. If you look at the then it can often explain the now. The media gives you a play by play, they don’t give you the playbook or the reason why because the why is often complicated and perhaps hard to understand. With this alternative approach to thinking about things in larger or wider historical contexts you begin to see how purposefully crafted legislation in the past can push the development of the country along in certain ways and directions. Generally, as I see it, things are pushed in the favor of the corporate class, the wealthy and the ruling classes interests. Manipulated legislation changes the landscape of the American economy in real terms and in ways a free market might not have pushed them if left up to an organic evolution of markets.

Looking at this timeline then we must keep in mind that in the 1960’s, corporations made stuff. The U.S. economy was a production based manufacturing economy at this time. Many were employed by corporations that offered pensions. Pensions were created in 1875 and back stopped by the public when large manufacturing employers who could no longer make good on their promises went belly up in the 1960’s. These promises were “unfunded” and thus, empty. How did REIT legislation affect the landscape of business in America then and why do I care? How does this all relate to pensions, bail outs and Build Back Better or tax payer slobs like me who now have to pick up the tab? Be cool honey bunny, we will get there…

By 1964 there were 7,600 shopping centers in the United States but by 1972, just 8 years on since then the number of shopping centers had doubled to 13,174. Was this growth due to the REIT investment legislation? I would argue that yes, yes it was. Between 1980 and 1990, there were more than 16,000 shopping centers built! ( http://bit.ly/3XnldoR ) In addition to shopping center and mall growth you have growth in new kinds of REIT opportunities that also juiced development. Here is a list:

1961: Shopping centers and malls

1967: Railroad real estate

1970: Lodging and resorts

1971: Apartments and warehouses / distribution facilities

1972: Central Business Districts / Office Buildings

1980: Racetracks

1985: Healthcare facilities and suburban office buildings

1986: Self storage

1988: Suburban office parks

1990: Net leased properties

1993: Factory outlets, golf courses, and manufactured home communities

1994: Life sciences buildings

1997: Movie theaters and correctional facilities

1998: Automobile dealerships

1999: Senior housing, telecommunications towers, timberlands

2001: Gasoline stations

2003: Bank branches

2004: Data centers, offices leased to the federal government, military housing and student housing

2005: Medical offices

2012: Pipelines and single family rental housing

2013: Farmland and casinos

2014: Outdoor advertising and business storage

2015: Electronic transmission lines, telecommunications fiber

2018: Refrigerated storage

2019: Post offices

Might this explain, if you’re old enough to think back, the boom in malls, golf courses, hotels, resorts, self storage, factory outlet stores, mobile home parks, etc? I believe it does. It overheats those markets with a flood of investment and then there is eventually a bust. REITs are also popular internationally, often creating similar bubbles in sectors of an economy. A fun fact I recently learned from a WKFR radio station FaceBook page post is that the largest land owner in Michigan is a publicly traded company named Weyerhaeuser with a market value of about 23 billion dollars and 13 million acres of forest under management. Weyerhaeuser is a REIT with a 2.33% dividend yield!

Your 401k at your workplace often invests portions of their portfolio in REITs which means a larger percentage of the population invests in REITs with or without their knowledge (approximately 44% of Americans with a retirement account).

As you put REITs and other pieces of legislation like the things found in Build Back Better into a larger historical context, you begin to see how the “sausage is made” or how a number of pieces fit together in cohesive ways. The creation of the modern mall and legislation promoting that model super charged consumption and “growth”. For a while, these malls were stocked with American made products, until they weren’t. 1979 marked the height of union labor membership in America at 21 million members strong, and is a lagging indicator of what essentially started in the 60’s. Continued growth especially by juicing the construction industry to build all these projects REITs created but there were dark clouds on the horizon because U.S. manufacturing was in decline.

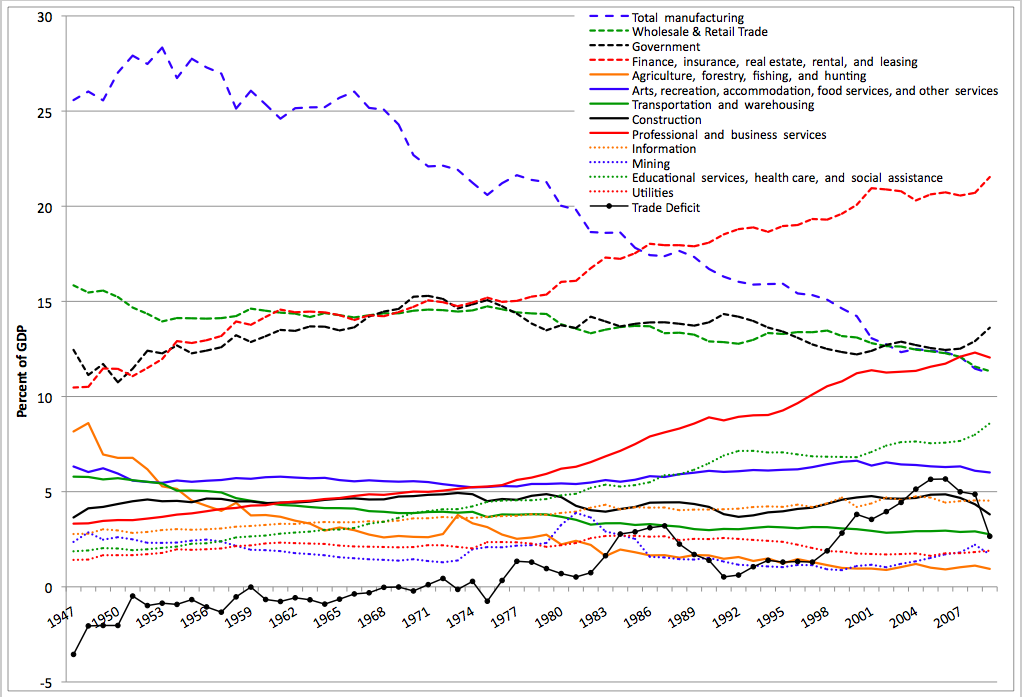

In the 1980’s and 1990’s the American economy continued the process of exporting productive manufacturing to other countries like, Japan, China, Mexico, South Asia, etc. In the 1980’s Japan was the number one economic threat to the United States and ranked as the #2 economy in the world…until it didn’t for reasons we won’t digress into. It was from the mid to late 50’s to the 80’s that the Midwest was rusting into what became known as the rust belt as manufacturing sectors of the economy moved to countries with cheaper labor and a favorable dollar currency conversion meaning that their dollar bought more in foreign markets ( http://bit.ly/3QrJJTi ). On this chart ( http://bit.ly/3WYzcS9 – which I have also attached to this post below) you can see that from 1950 to 2007, “total manufacturing” inverts against “Finance, Insurance, Real Estate (FIRE), rental and leasing”. The top two lines, the blue dashed line declines while the red dashed increases. Another interesting observation is that “Professional and business services”, also known as the “service sector” goes on a similar trajectory as FIRE and combined they replace manufacturing in terms of GDP.

This means that manufacturing or the production of stuff declines as finance, insurance, real estate and leasing which are all “non-producing activities”, increases as a percentage of GDP (Gross Domestic Product the sum total of all things produced in the country). This inverse relationship demonstrates CHANGE and a SHIFT in the economy and what the economy actually was to what it has become. The economy evolved.

This chart and the history of legislation behind it is “the smoking gun” that demonstrates the de-industrialization of an American economy and its conversion into the financialized and debt leveraged economy that it is today. American capitalism, one that produces and is largely self reliant has been turned into “rentier capitalism” and dependence. Rentier capitalism is a system whereby the ruling class earns income from capital without working or producing a product. It is income created from rent, interest on bonds, dividends on shares like from REITs, and other yield producing assets ( http://bit.ly/3vWReYR ).

The landscape of this narrative I put forth demonstrates the conversion of a working class America during a certain time who enjoyed decent wages and a solid pension into one where 18% of Americans get some form of government assistance while others in a tier higher are working to pay down accumulated debt on a treadmill barely able to move forward. We have been marching toward something Joel Kotkin in his book “The Coming of Neo Feudalism” discusses called neo feudalism. We might actually be experiencing much of what he discusses in his book right now. The REIT and other acts of congress including executive orders by any number of POTUS’s push the country in these directions.

What I have discussed thus far is why I often say that these things are “planned”, they don’t “just happen”, it isn’t the “winds of change” or like Adam Smith famously said and as Conservatives / Republicans sometimes like to loosely quote, an “invisible hand”. On the contrary, the wealthy influence the rule makers who are also themselves part of the “ruling class” to make rules more or less favorable to the wealthy and not you. The invisible hand is quite active and opaque if you look! These rules and laws direct the flow of capital, investment and growth with carrots and sticks in any number of directions. Carrots are usually in the form of subsidy like tax credits, favorable loans or direct cash assistance with grant money. Sticks are usually in the form of higher taxes on profits or other disincentives on those directions like compliance hurdles.

The Kicker

Bringing this back to Michigan, I now understand why the Snyder administration, in an attempt to drum up revenue for the State of Michigan decided to start taxing retiree pensions in 2011. This has, as of the writing of this piece, not been undone by the Whitmer administration lead by a democratically controlled house and senate nor do I expect it to be. It is early yet for something like this to be tackled however, if it was in her sights, there should have be a plan with a trigger that could easily be pulled at the start of any legislative session.

Have you ever asked why Snyder and Republican legislators targeted pension recipients? From what I can tell and according to the former governor, the pension tax brought in about $930 million dollars a year in tax revenue. He and the Republican legislature shifted a tax burden from businesses onto retirees with PENSIONS but why? The pensions are back stopped by the Federal Government and are too big to fail! That’s why! This is what we have learned.

Pension tax revenue is far more guaranteed than a Michigan Business Tax (the MBT) which can wildly fluctuate during good or bad economic times. You can hopefully see now that…pensions, those are guaranteed and steady regardless of the economic environment! Corporate entities like the PBGC can not be unwound without political consequence. So, what happens in bad times when in just a few years the PBGC could be insolvent? What happens when the PBGC threatens to cut pension benefits by up to 60% because they are running out of money? Money printer go burrr! POTUS to the rescue! The value of the dollar is continually debased and the money supply inflated to back stop an inability for a pension Ponzi scheme to be able to meet its financial obligations to its investors. If it were not government backed these folks would be politically motivated to vote for the other, perhaps a third party, perhaps not. At the very least, if not government backed, like any Ponzi, the last one’s in would be left holding that bag. They would need to pay more into their pensions, go back to work or find alternative investment vehicles besides government backed pension plans.

Fun facts, as a percentage of Michigan’s total workforce, union membership is 13.3% of the total number of workers in the state ranking 12th in the country among 50 states. Michigan ranks 8th by number of workers who are represented by a union at about 620,000. Because of “right to work” laws making union membership non-compulsory, 2% of those benefiting from union bargaining power are not actually union dues paying members which would bump Michigan to 11th instead of 12th with 15.3% of the workforce being unionized. That 2% number is surprisingly small in my mind ( http://bit.ly/3GSTaIr ). Can you see then why the Snyder administration targeted retiree pensions? It is genius financial slight of hand to mitigate risk by dunking on pensioners and the public! The Snyder administration dunked on people outside of Michigan! One of the all-time-greats if you think about it when it comes to financial trickery but what else would you expect? Finance was his specialty!

Wrap up

Build Back Better is really “Bail Out Better” in many respects and a window into something far more devious when viewed through the lens of history. It demonstrates how pension obligation systems concocted by the establishment decades ago are perpetually propped up shifting liability from the private sector to the public sector operating much like a publicly backed Ponzi scheme. Private Ponzi schemes fail but public Ponzis continue in perpetuity! The State of Michigan continues to abuse this scheme to guarantee its own consistent revenue stream to the tune of almost $1 billion dollars annually. Build Back Better not only bailed out a failing private pension fund but also the State of Michigan in a clever indirect way! The public at large is ultimately responsible for a small percentage of the American working class who’s investment vehicle continues failing miserably and will fail again. These schemes, unlike other Ponzi schemes, are not allowed to actually fail like your investment portfolio might. That is, if you’re lucky enough to have one. The history behind one of the investments in the PBGC, REITs, is a smoking gun demonstrating how the ruling class manipulates the larger American economy to their benefit in a kind of pump and dump money making scheme. Government and investment advisor propaganda would have you believe that REITs were invented to democratize interest bearing income investment opportunity for the little guy to build little guy wealth. On the contrary, it shows how the sausage is made and that the American economy is really a Jenga of rules, regulations, policy, subsidy, incentives and market manipulations benefiting a minority at the top, as George Carlin again once said, “the real owners of this country”. Legislation like this helps to build the leaning tower of capitalism made of Jenga blocks which, depending on certain global geopolitical winds, may eventually topple.

Jenga!

The American economy is nowhere near representative of a “free market” that many speak of. It simply doesn’t exist. The America I know is not the land of opportunity it once was, if it ever truly was when government was smaller, less active, less intrusive, less invasive, less manipulative and less manipulated. As power continues being consolidated among the wealthy who control government, the less power you will have. Ponzi schemes that are too big to fail need to be unwound but won’t be by the duopoly (the combined forces of the Democratic and Republican parties). They can not withstand the backlash to the pain it would cause for a few. Instead of doing what is right for the many, they choose to abuse the many in favor of the few. There could be better solutions for retirement based on levels of age and risk tolerance, options for self direction or perhaps a hands off approach with low yield but that guarantees your nest egg during retirement. This could be done knowing the risk and without dumping liability onto the public because the investor could take the personal responsibility and destiny of outcome into their own hands.

The American people won’t win an election until they vote for and elect even just a handful of third party candidates to dilute the egregious power of the duopoly.

The Straight Dope on College Tuition and Student Loans

The Straight Dope on College Tuition and Student Loans