Author: Rafael Wolf | Libertarian Candidate, Michigan House of Representatives

Editor: TBD

Benjamin Franklin once wrote…

“Our new Constitution is now established, everything seems to promise it will be durable; but, in this world, nothing is certain except death and taxes.”

Constitution Daily

How true?! When discoursing about taxes, most people automatically think about income taxes. This was Mitt Romney’s rhetoric when discussing the topic during his presidential bid in the 2012 political cycle for president. Here, the part when he says, “…who will vote for the president no matter what” is a dig on voters supporting incumbent President Barack Obama at the time and what he means by “the president”.

“there are 47 percent of the people who will vote for the president no matter what” because they are “dependent upon government … believe that they are victims … believe the government has a responsibility to care for them … these are people who pay no income tax.”

National Public Radio

In fact, once again, establishment politicians, duopoly candidates, in bi-partisan fashion seem to be singing similar tunes but marching to a different drum beat. Mitt’s comment is similar in nature to Hillary Clinton’s “basket of deplorables” in the 2016 presidential campaign season for president. Running against Donald Trump in 2016 she said in a speech…

You know, to just be grossly generalistic, you could put half of Trump’s supporters into what I call the basket of deplorables. (Laughter/applause) Right? (Laughter/applause) They’re racist, sexist, homophobic, xenophobic, Islamophobic – you name it. And unfortunately, there are people like that.

Hillary Clinton 2016 campaign speech, Sept 9th, 2016

Politicians love turning people into statistics, they love putting people into buckets (baskets) and they love making wide sweeping statements with a shop broom categorizing them in big chunks so they can focus their message getting the most bang for their buck on the campaign trail. It is a tactic to identify an enemy, your enemy, making your fellow Americans or those living in America, your adversary. Why not make an enemy out of people you know, as a candidate, who won’t vote for you? You are not losing anything by doing so and perhaps you will get support from the others you can convince that indeed, they are deplorable! Indeed, they are tax cheats! Both Mitt and Hillary have their basket of deplorables that do not vote the way they like or pay enough taxes.

Political hacks like Mitt, who I would not trust as far as I could throw, are suggesting that a certain segment of the population are getting away with something by not paying income tax in addition to getting government care. Presumably, in republican parlance, he means care in the form of welfare and like his Democratic counterparts, he claims there are people “not paying their fair share”. Listeners ears perk up hearing things they like or that confirm their bias. I do! don’t you? This is known as a “dog whistle“. Hearing someone reiterate the belief that there is a class of citizens taking advantage of the system and that they are getting something for free or that there are racists who support a candidate you love to hate. To a large portion of the country, hearing Mitt’s words feels good and pleasing to their brain. Mitt is actually echoing an argument which is perceived as being “lefty” by most but saying it in a different way. In fact, he does it simply by targeting a different social class. Being “pro-tax” is dogmatically seen as a democratic value but this is only partially true. The electorate, those who vote, should recognize tax rhetoric as class rhetoric but they should also realize that both dominant establishment political parties, the duopoly, absolutely love taxation in its many forms. Mitt’s rhetoric, the things he says, targets the middle and lower class, although, the fact that almost 50% of the country does not pay net income tax would indicate there is no “middle”. In the U.S., there is a top 50% and a bottom 50%. Logically, a middle class would pay some income tax but it doesn’t. Progressive arguments, or those who argue on the political left of a linear spectrum, Democrats, like that of Bernie Sanders and Alexandria Ocasio-Cortez (AOC) are saying the same thing as Mitt but simply have a different class target in their sights. Their rhetoric, opposite of that from Mitt, targets “the rich”, in fact, often the top tenth of one percent also known as the “extremely wealthy” which Mitt happens to be a member of. Sometimes you find the very people who rail against the wealthy, are wealthy themselves.

Establishment candidates from both parties, Democratic and Republican, think that someone is getting away with something and not “paying their fair share” or that they are abusing the system in some way or getting something for free. The irony here is, this is the very system the establishment has built the past 150 years or more benefits themselves and their supporters, the wealthy donor class or the vilified poor with all manner of accounting book cookery. Now they choose to complain about it? That is laughable! The irony and hypocrisy from a scale of 1 – 10 is an 11!

The irony and hypocrisy of the very class, the political elite, who continually abuse the system to front run the stock market, using conflicts of interest to perpetually and increasingly fund the military who’s stocks they buy and invest in is off the charts. These are the people, regardless of political party in truly bi-partisan ways, who manipulate markets for their own personal gain among the many other abuses of their very own power both domestically and abroad. Their behavior is stark and plainly in view if you look even with only a passing glance. Your elected officials are out of touch because they are the definition of wealthy, elite, above the law in many cases and therefore corrupt operating outside of the system we all live in.

Member average net worth of a U.S. Senator for example has gone up not down. From 2004 to 2012, for the Democratic side of the aisle it has gone from $2.5 million dollars to $5.7 million dollars. On the Republican side of the aisle, it has gone from $5.7 million dollars to $7.6 million dollars. Here is a list of congressional leadership net worth. I am certain it has only gotten worse in the decade since that study has been done. Of course, the United States is a business model and business people run the country at the behest of their businesses, other businesses and multi-national or trans-national corporations who fund their campaigns. When you begin looking at the lists of wealthy politicians you start to see patterns in descriptions such as so and so “…is an American politician and businessman”.

- “Richard Lynn Scott (né Myers, born December 1, 1952) is an American politician and businessman…”

- “Mark Robert Warner (born December 15, 1954) is an American businessman and politician…”

- “Gregory Richard Gianforte (born April 17, 1961) is an American businessman, politician, software engineer, and writer…”

- “Paul Mitchell III (November 14, 1956 – August 15, 2021) was an American businessman and politician…”

- “Willard Mitt Romney (born March 12, 1947) is an American politician, businessman, and lawyer…”

- “Vernon Gale Buchanan (/bjuːˈkænən/ byoo-CAN-nən; born May 8, 1951) is an American businessman and politician…”

- “Michael K. Braun[2] (/ˈbrɔːn/; born March 24, 1954) is an American businessman and politician…”

- “Donald Sternoff Beyer Jr. (/ˈbaɪ.ər/; born June 20, 1950) is an American businessman, diplomat, and politician…”

- “Dean Benson Phillips[1] (born January 20, 1969)[2] is an American business magnate, liquor heir,[3][4] entrepreneur, philanthropist, and politician…”

…it is not until you come to Nanci Pelosi, the 10th wealthiest congressional leader, that the information gets obscured. She is not listed as a “businesswoman” but she clearly is. Her husband has his hands in financial leasing services, real estate, venture capital and consulting firms. Her net worth is estimated at $114 million dollars. Other female legislators like Dianne Feinstein who are wealthy are not described as as “businesswomen” but some are. It seems the term “businesswoman” is not as prevalent among female members of congress as it is with their male counterparts. Even the poorest among the legislators are rich in the eyes of an average American. This class of citizen, the businessman, the politician, the wealthy person, has the money, connections, opportunity and time to run for office. These people are plugged into the political class or have deep rooted connections into the process of politics among the dominant parties in America (the duopoly). The vast majority of politicians are business people, attorneys, bankers and physicians or that come from other white collar backgrounds including academia or a privileged lifestyle of inheritance like Peter Meijer who has assets of approximately $50 million dollars (although, unbelievably primaried out of his seat by John Gibbs who is allegedly worth over $2 million in net worth). These people are elites attempting to convince you of their blue collar street credibility, of which, few have any to speak of. The list is long especially if you begin with the “Founding Fathers” or look at past presidents. Politics, running for office, being part of the managerial class of elites that run the country is a country club.

All this begs many questions, one is, why do voters continually elect oligarchic overlords who are self interested in the preservation of their own personal wealth and power? The answer is, that they are generally tricked by the onslaught of propaganda convincing them that, so and so politician is “for the people,” and so and so politician is “fighting for you” to take something back that was stolen or taken. That is a category five out of five on the stinker meter. Five big ole number two dumps onto your head, dear voter. Whatever you think was taken or stolen from you was taken or stolen long ago, believe it or not, and much of the public’s perception of what they have, is just that – perception without actually having much. Another question comes to mind, just who is paying taxes? Why or why not are they paying and how much? The “Tax Policy Center” did a lengthy piece on income tax and tax revenue. They often get cited when tax issues cycle around in the news because of some monetary scare, discussion about trade deficits, annual federal budgets, or the nations “debt” ($30.6 trillion and counting). The IRS has a long list of deductions for “individuals” while corporations employ armies of tax lawyers and tax accountants with tax deduction opportunities far too long to list. The wealthy and corporations can spend money to practice something called “tax avoidance” which can include anything from using credits here at home or offshoring assets overseas through subsidiaries to avoid paying taxes to the United States government, state government, or local government. They are so imaginative and creative!

When you claim federal tax credits and deductions on your tax return, you can change the amount of tax you owe.

Credits and Deductions for Individuals

Tax avoidance is a perfectly normal thing to do for anyone wanting to preserve their wealth (cash). Tax avoidance should not be something establishment party politicians like Mitt, Bernie, or AOC have a right to complain about when these are the very laws they historically enacted or continue to support as members of their respective parties. That is what Mitt, Bernie, and AOC are doing! Politicians like Bernie and AOC publicly rail against tax loopholes while doing very little functionally to attack that system and who very likely leverage every existing loophole for their own financial advantage to preserve their own wealth. Nobody ever asks Bernie or AOC, as far as I know, if they choose to pay more taxes than they owe, foregoing the use of any tax loopholes on moral principal! They will not tell you about their own hypocrisy in full disclosure. The tax system is not honest and neither is your Democratic or Republican representation. The types of tax avoidance lower classes participate in are simply different than that of the wealthy. In fact, it is mostly considered “illegal.” A person in the lower classes of society might not take a job or a job promotion because, in an odd, counterintuitive way, they make more money in their gross paycheck, the amount they are paid before taxes, but their net income, after they pay taxes, is less. This is because they are bumped up into the next tax bracket which penalizes their gross paycheck taking out a graduated and higher amount in tax because of the current “progressive tax system“. In this scenario, they will make less net money per paycheck than they did in their prior job role. Yes, this happens! In addition to their gross incomes being higher but their net incomes being lower, because they make a higher gross income, they may lose welfare benefits. Yes, this happens! It happened to my mother when I was a child. i

In fact, and I clearly remember the effects forcing us to move from government subsidized housing in Gurnee, Illinois, into non-subsidized housing over the Illinois border into Genoa City, Wisconsin, where un-subsidized monthly rent was far cheaper than un-subsidized rent in Illinois. This added 40 to 45 minutes or more of drive time to my mothers job at Baxter Laboratories, formerly known as Tower Manufacturing, in Round Lake, Illinois. This drive time was exacerbated by having unreliable transportation, increasing amounts of suburban rush hour traffic, and any number of seasonal weather conditions. Tax policy impacts the lives of everyone, both rich and poor. Other forms of tax avoidance for lower classes also include, “working under the table“, which my mother also participated in, under reporting the sale price on a used car, which I have been personally asked to do on a sales receipt (but refused) and thus, having to pay less in tax on the purchase at the Secretary of States office for the used vehicle when registering it with the state. Tax avoidance of the lower class also includes endeavors like the buying and selling of goods or services outside the prying eyes of regulatory tax authorities for cash (like bootlegging goods), usually domestic labor (cleaning, home services, construction, etc), and other things that you do not claim your income on. A special note, this type of behavior is not solely for the lower class. The wealthy also tax dodge by employing the services of illegal aliens paying cheaper labor dollars to these individuals. They do not have to “employ” these dedicated laborers and skirt the legal labor system. The wealthy have a symbiotic relationship with working under the table employing servants, maids, construction workers, lawn care maintenance workers, etc. Remember, the elites live in a world of narcissist hypocrisy of, “Do as I say, not as I do“. I once had a neighbor across the street from me operate an “illegal daycare” in her rental home receiving cash under the table payments and was unlicensed as a care giver. In fact, I was also babysat as a child in an unregulated illegal day care by a neighbor in our subsidized housing development. Rose Lassen (Rosie or Rosemary Lassen), who knows if she is still alive, introduced me to the love of hotdogs mixed in with macaroni and cheese any time of day! I have fond memories of Rosie. Yes, these are all “illegal” activities in the eyes of the law and are considered a part of the “underground economy” of cash or reciprocal transactions that go un-taxed. Rich people behave differently than poor people when it comes to behaviors of tax avoidance primarily because of the volume of money involved they desire to hide. Tax avoidance is not “illegal” but working in an underground economy is considered as such. Why? Mainly because the wealthy have bought the politicians or have become the politicians who make the rules on their own behalf or on behalf of their own business interests, creating “legal” tax loopholes to avoid the payment of taxes including their own businesses. Being a politician with business interests in my view, is a conflict of interest. Most politicians have conflicts of interests but continue running for office instead of recusing themselves. It is one of the many benefits you have as a politician, rule making, and it can be quite lucrative! Full disclosure, I own a business! I have no government contracts, nor do I want any, nor do I plan on leveraging government for my personal gain punching holes into tax code.

Legislators enact taxes, then poke holes in the tax structure often because it benefits their own business interests or the interests of the donor class who fund their campaigns. The right of the political spectrum wants to tax the poor, the left of the political spectrum wants to tax the rich and this is the game they play never discussing the current system, both wanting to tax more not less. Working in round numbers “for easy math” as an economist professor of mine used to say, the U.S. receives approximately $4 trillion dollars annually in tax revenues. The U.S. spends almost $7 trillion ($6.8) annually. That means the U.S. deficit, the difference between income and expenses, is $3 trillion. $3.3 trillion of the revenue are from income taxes and payroll taxes and only 373 billion are from corporate taxes with additional revenue from things like tariffs. This is why politicians on the left want to tax corporate America more, because with reductionist thinking, they see individuals paying more and corporations paying less not recognizing that regardless of your political view, the U.S. already spends more than it makes. Medicare and Medicaid spending is $1.9 trillion annually, money spent in a poor healthcare system that is twice as expensive as most other countries in the first world which makes it terribly inefficient. Spending on Medicare and Medicaid is almost 50% of the nations tax revenues annually. DataLab has a wonderful graphic you can click on to drill down into national expenses. Of course, currently, the United States is a business with an unlimited credit card. The discussion on taxes very rarely discusses the outlandish spending it already does in systems like health care that offer little value for the money spent which should be a starting point.

Interest on the public debt is $562 billion which ebbs and flows depending on LIBOR or whatever new interest rate metric the U.S. government wants to replace it with (I think they have). The “Department of the Treasury”, which includes the interest on the debt, is $1.6 trillion in annual expenses. The federal budget is one thing, and complicated, state budgets are another and also complicated. If the public continues electing duopoly candidates, the financial condition of the country and your state will be in dire straights in a continual spiral downward. The State of Michigan often relies on Federal bailout money to plug holes, you hear this now from elected officials who think the state is “flush with cash”. This money will not always be around and you only notice the financial stress on a state like Michigan in times of economic hardship which may be approaching as “recession looms”. A strong financially independent state should be the top priority of any legislator with a focus on debt minimization. Financial power is real power in the marketplace and paying interest on debt to bond holders saps financial power transferring it upward. One author, Joel Kotkin, “The Coming of Neo Feudalism”, discusses how the wealthy use government debt as a mechanism to transfer wealth upward to themselves from the lower class, you the tax payer, in the form of bond interest governments pay. People think that government debt is a good thing. I suppose it can be but not in this instance and this is the point. Lets unwrap how things work and see the truth behind systems put in place by the ruling class. Why is it a good thing that government goes into debt again? The answer to questions like, is government debt good or bad (?), depends on how it is structured and who benefits! The CBO, Congressional Budget Office, concluded that to stabilize “the problem” of national debt, that the government will need to increase taxes and decrease services. Yes, dear reader, ole Mitt, ole Bernie and ole, but young, AOC will eventually tax more and give you less for it! Guess what, they will tax both rich and poor more, not just the rich, not just the poor and in so doing, as Joel Kotkin alludes to, they will make ever larger loop holes and pay ever higher rates of interest to offset the real pain to the wealthy, while maintaining the public perception that the wealthy are participating in a payback scheme. They will continue transferring money upward in the form of interest payments from the government and thus, you the actual tax payer.

What are Taxes?

Taxes are compulsory demands by government or a mandatory demand by government to give them your money whether local, regional or national but its worse than that actually. This is why the majority of libertarians suggest that “taxes are theft“. It can be argued that indeed, they are because of their compulsory nature. Taxes, if you think about the complexities of society and you in it, in my personal view as a Libertarian…

[Taxes] are the cost of doing business as a member of society.

– Rafael Wolf | Libertarian Candidate for Michigan State House Rep, 41st District

The “cost of doing business” is an economic term and, if applicable, how I mostly understand the world. I understand the world often through the framework of economics and economic relationships. Unlike some Libertarian tropes and stereotypes, not all Libertarians think that government is totally useless, does a horrible job in all cases or that society does not need one. Nobody is perfect, neither is government, your preferred politician, you, your mom, your religious leader, your dog and cat or anyone else you know is not flawless. Suggesting that government is totally inept or useless is not an honest argument and to think you do not need a government would be an anarchists perspective. I happen to not be an anarchist. For example, and I think you may agree, I like decent roads, bridges, rail, and other infrastructure like electricity so I can easily walk or drive to the Hardings Market for an occasional food purchase in an orderly manner with red, green and yellow traffic signals, lines painted on the road, street signs and such along the way. I think, as a function of government, providing basic infrastructure like a decent road system for commerce is perfectly acceptable and a “public good” that society immeasurably benefits from. That I immeasurably benefit from. I find it gross and totally dumb that “fixing the damn roads” was even an issue in the last gubernatorial election. Isn’t that the least we should expect from the ruling managerial class? It was astounding how this became a political platform plank or that the media perpetuated it as some kind of big deal. The bigger deal is how they became in a state of disrepair! If I am in need of an ambulance, a good unobstructed road with a quick route to my home is a priority lights ah-blazing and horns ah-blaring! The root cause analysis here is not, in my view of whether dollars are being stolen from me, that is obvious, but what value those dollars might be to myself as a member of a larger society, aka “civilization“. I want good roads, good education, good water, good air, and more. I want the good good! Do I think we pay too much in tax? Yes! Do I think the government is spending or using those tax dollars wisely? No! The inefficient use of the dollars or the wasting of my dollars is the theft in addition to the $3 trillion in national deficit spending annually. It is not a question of whether we should pay or not pay taxes, it is a question of whether we are paying taxes efficiently on things most beneficial to society, that, as a whole, we can all benefit from in the form of a civilized society. To be clear, I am not advocating for Libertarian Socialism although, I am not apposed to many of those ideals like maximizing individual liberty, minimizing state central control and empowering the working class through freedom of association. I am simply arguing that tax minimization does not mean elimination and that taxation is a necessary part of life, like Ben Franklin noted but many do not think about. The opposite of “death” is “life”. Nothing is certain except death and taxes (life). We should reflect on this truth and reflect on Ben’s words in this way.

To summarize, taxes pay for stuff. I like stuff but not all stuff. Taxes are also abuse. I do not like abuse.

More About Taxes

This is where we discuss an expanded understanding of taxes, their use and their leverage. There is more to the discussion about taxes than “income tax” or how people dodge them which, as we have seen, every politician loves to get you thinking about because it is a matter of “class warfare“. They love to get you thinking about income tax and that others, by not paying them, are not paying their fair share or getting something for nothing at all levels of the class structure. The rich are stealing from you not paying their fair share which is why you suffer! The poor are getting welfare and stealing from the most productive members of society, the rich, the creators! This is the common rhetoric you hear is it not? This is the language of pitting classes against each other. Their are far more poor than there are rich by the way which is why the “we are the 99%” Occupy Wall Street crowd was popular for a short while.

Besides the income tax there are consumption taxes like sales taxes, tolls, special assessment taxes, taxes for business, fees, fines, debt, a form of tax on your future in the form of interest to a bond holder, licensing, corporate welfare (“subsidy”) which is a tax credit to businesses and debt put onto the public, tax cuts could also be considered a tax, believe it or not, like debt, which is a tax on future revenues at a particular interest rate, inflation, monetary debasement and more. A special note here from an economics perspective. You know that gas price you are feeling ($4-$5 dollars gas per gallon)? Many think it is “inflation”. Inflation is the reason given for higher gas prices in the news constantly. Price increases are due to “monetary debasement” and not “inflation” among other things like supply and demand, supply chains, investment in oil exploration, and other factors. If you have time, you should read about “monetary debasement” as it will put price increases into the proper perspective as it is far too large of a topic to shove into this discussion but well worth your time. In technical terms, “inflation” is a term used for increasing the money supply and monetary debasement is a term used to describe what your dollar can buy or the buying power. We are all seeing debasement of money and price increases which is not technically “inflation” as you will come to find out.

There are so many things in the form of a tax that it can and should make your head spin thinking about them. Many taxes are in my basket of deplorables! If you are now thinking about them and can not sleep, for that I apologize! There is nothing simple about a country, state, county or city’s tax structure. Lets think about my average day, perhaps it is a lot like yours…

- Alarm rings at 7am, powered by electricity I pay tax and fees on, some of which I do not even understand!

- The alarm is on my phone, to use my phone I have a phone plan where I pay taxes.

- My phone happens to be connected to my WIFI which is taxed by my service provider (AT&T).

- That reminds me, I got a good nights sleep because of how hot or cold my house was, more taxes on the utility of heating or cooling and we pay more or less depending on how much electricity or gas we use to heat or cool.

- I take a shower, both heating the water and using it.

- I use soap, shampoo and brush my teeth, certainly not in the dark, all requiring me to pay taxes on my consumables, the heated water, the water, the lights, toothpaste, soap, my clean towel, etc.

- That reminds me, you know…to sleep in my bed comfortably I needed clean sheets, that was brought to you by my laundry system that requires water, electricity and soap to both wash and dry my clothing and sheets!

- I then make coffee or breakfast…more heat from the gas company or electric company and if you eat cereal, what do you think keeps things cool or frozen? Indeed…more taxes on the consumption all day!

- I then get into my car. I pay taxes on the gasoline running it. I pay taxes, presumably on car insurance in addition to it having been registered and licensed.

- I pay property taxes in the very house I live in and the very driveway my car sits in.

- At work, I may go out for lunch and of course, on that prepared food, I pay a tax but I consider my tip, if I leave one, a reward for good service and not a tax. Tips are earned not given.

- Driving home, as when driving into work, the tax meter is ticking every mile as I consume the fuel.

- Perhaps, in the evening, I want to stream a movie on a streaming service, I pay taxes for using their service.

…every minute of the day, as you consume services or goods, you are being taxed. It is a form of neo-feudalism, as mentioned before, where you toil a field know as the economy, to pay taxes and die (thanks Ben Franklin). Taxation takes your personal financial liberty from you and transfers it upward, to the state, the corporate class or oligarchy. Money is moved from the masses, to the few which is then transferred in many interesting ways some going back downward but a large portion skimmed off for the wealthy and the elite. Again, the issue of taxation can easily get complicated, I could easily wander, as I often do, but you should be thinking about yourself in my scenario. How you are taxed throughout your day, week or month. Not only does the federal government tax you, but so does your state or local government and they coerce corporations to tax on their behalf too! There are taxes you pay and do not even realize you pay them or systems of welfare you pay for which you may not even realize! Lets check out one of my bills in detail…

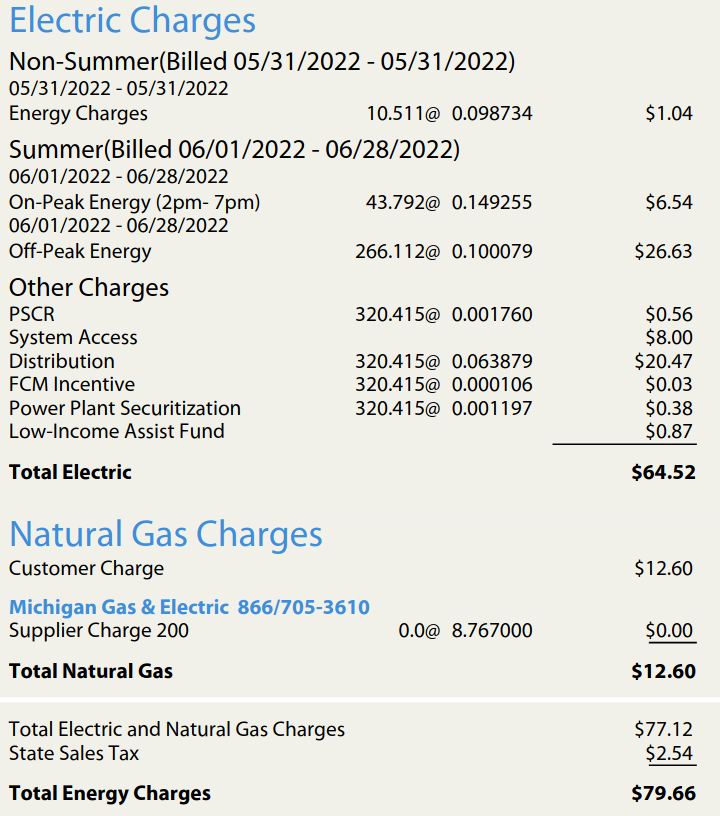

Here is my Consumers Energy bill:

You may be asking yourself, how in the heck is his entire utility bill only $80 dollars? Well…I live in a very modest two bedroom one bath home but the real question is, how often do you scrutinize your bills in this way? It is likely, never, you just pay it. What I notice on this bill are on-peak and off-peak rates, variable rates based on demand in which you pay more or less for energy consumption which depends on the time of day you use the energy. Of course, the bulk of my consumption comes in the evening, maybe like most. You see something called “PSCR” charges, I had to look up what that is. PSCR is Michigan law baby! Can you believe that? Good luck reading it and interpreting it here and here. Supposedly Consumers Power does not make money on this charge, maybe they do, maybe they do not, I do not happen to know. At this point on my itemized bill, I already feel nickle-and-dimed. You then see “System Access Distribution” charges. That seems to be defined as “An MPSC-authorized monthly charge to recover the costs of metering, billing and other customer-related operating costs, exclusive of demand and energy consumption”. On your bill then is a “Michigan Public Service Commission” authorized monthly bill to charge you for charging you! It is like adding a “service fee” for the service or a “convenience fee” for the convenience! We then see an “FCM Incentive” which means, “Financial Compensation Mechanism (FCM) Surcharge”. What in the world is that?

An MPSC-authorized charge based upon the electric energy (kWh) used by the customer to recover compensation associated with solar power purchase agreements. The surcharge is effective for service rendered on and after January 1, 2021 and was authorized by an MPSC order on December 17, 2020 in Case No. U-20697.

Explanation of Consumers Power energy charges

Again we see the “MPSC-authorized”! I am paying $0.03 cents for something related to solar power purchase agreements. I can not say I fully understand why I would be paying for that but I suspect it has something to do with integrating solar panel fields or home rooftop solar into the grid. If anyone knows more, feel free to reach out and help me explain it all! We then move on to “Power Plant Securitization”. This has something to do with Consumers issuing bonds, which seem like debt to me, and somehow their debt is ending up on my bill and we all pay for it. By the way, the “ROE” is “Return on Equity” at %9.9. This is a favorable return! I would like to know more about that! Again, I do not pretend to understand this without further investigation and there is nothing I can do about their business practices unless elected. Urban residents are somewhat compelled to be hooked into centralized infrastructure. Going off grid in most well connected urban situations would be difficult I suspect and not necessarily convenient. Part of what residents pay for here is the convenience of sewage treatment, the clean and safe delivery of water and power although, as we have seen with Flint or cities like Benton Harbor, centralized infrastructure can fail the tax payer with long lasting effects. Exposure to lead in the young will have life long and possibly multi-generational effects. Lastly on my bill, we have a “Low-Income Assist Fund”. What is a low-income assist fund!?!? Sounds like socialism comrade!

This is where your “conservative Republicans” should have a hypocrisy check with their party of preference. What Russian sympathizer do you think instituted this socialized welfare program? Governor Rick Snyder of course under a fully staffed Republican administration having a “trifecta” as they say in the House, Senate and Governors office. Perhaps team red should slap on the ole hammer and sickle into their elephant logo montage?

On July 1, 2013, Governor Rick Snyder signed 2013 PA 95 (Act 95) into law to create the Low-Income Energy Assistance Fund (LIEAF). Monies from the LIEAF are distributed by the Department of Human Services to support low income energy assistance during the heating season for all Michigan residents. The Commission may annually approve a low-income energy assistance funding factor no later than July 31 of each year for the subsequent fiscal year. The factor is a surcharge added to each retail billing meter. The factor is the same for each customer class and cannot exceed $1. On July 27, 2021, the Commission approved $0.87 as the funding factor, effective beginning the September 2021 billing month

Explanation of Consumers Power energy charges

I am not making a judgement on the value of such a program, I simply note it because it was on the utility bill and the common understanding of right leaning politics is that they hate welfare unless it is from a church, volunteer organization or another religious institution. That, right leaning politically minded folks “hate socialism” or anything that smells like it. The fact is, the theory of aversion to socialism the pundits pound into the heads of their right leaning voter bases, is just that, a theory. In practice, it is Republican socialism all the way baby! You do not have to look further than your utility bill to find it. Your Republican lead legislature is leading the way on the welfare scene! Who knew? I can imagine anyone who is a Republican or “Conservative” reading this is setting off in a new tab to Google the shit out of my claims. They are real people!

You can see then, that even something as simple as my utility bill gets whacked with taxes, fees, special fees or charges including directly subsidizing the poor and investment interest on ROE at 9.9%! All you can do, is pay the bill and shut up. Take a look at your telephone bill (Verizon), your Internet bill or any other bill that has a detailed break down of all taxes and fees. Some of these fees are business driven, some are not. On your cell phone bill you pay something called a lifeline program for low-income consumers covered under your “Fed Universal Service Charge”. Notice the “Universal“, they do not mean the studio! That means “everyone“. This welfare program too was implemented by another Communist sympathizer, Republican President Ronald Reagan in 1985 (I have to “LOL” here calling them Russian or Communist sympathizers!). The chief complainer of “the welfare queen” himself implements a welfare program keeping the queens in his court if they know what’s good! Oh the irony! George W. Bush, another Republican President, yes, and “fellow traveler“, later expanded it to include cell phones. If you didn’t know it, Republicans seem like they sure like welfare programs! You often hear this program referred to as getting an “Obama phone“. The term “Obama phone” is used as a pejorative from the right against the left and against the poor who qualify for such phone, internet or similar programs. Republicans now in the know can not un-see these facts because nothing could be further from the truth! Reagan phones baby! Bush phones baby!

This is why the narrative about taxes and welfare is borked from the beginning of any discussion on the topic. Most citizens do not realize the complexity surrounding taxation. Those who like it, promote it, and who implement it in any number of ways. Like the clever use of services or products from corporations to extract your wealth in the form of a “fee” to redistribute income upward and perhaps back downward. I say “perhaps” here because, they keep some for themselves (wink wink). Most people’s understanding of the subject matter is a bit of a myth or so complex, they can not understand it therefore minimizing the topic like Mitt, Bernie and AOC do to income taxes. Pay no attention to the man behind the curtain (your overall tax burden). Both political parties love taxes, they love welfare, they love inflation, they love monetary debasement, they love fees, they love big government, they absolutely love wealth redistribution; upward of course, in a big uni-party love fest to their donors or themselves at the top holding hands with the nations bond holders earning nice guaranteed returns from the serfs toiling in the field.

A Brief Word on the Police State

Did you know that the police state is a mechanism not only for “social control” as most think but that it also exists as a mechanism for wealth extraction and taxation? You may not have thought of this before or thought of “policing“, ahem…excuse me “public safety“, in these terms because policing is firstly a tax payer funded endeavor. This form of police funding is top of mind for most who complain about the po po. You pay taxes to an oppressive state that then, through an almost paramilitary storm trooper force, further oppresses you or others who also surveil you or your community in any number of ways. When I say “surveil”, I do not mean routine “patrolling” but active surveillance as Elizabeth Hinton discusses in her book about “the war on’s” found in my reading list. Unless of course, you have never gotten a speeding ticket, a seat belt violation, a parking ticket or any other things that an officer can potentially pull you over or stop you for.

The fines and fees you have to pay, in addition to the taxes you pay that fund police forces is a trickle up of mostly money from the bottom to the top that funnels into judges retirement funds, funding courts, state treasuries, libraries, and variety of other things the police state is interested in funding. In a memo to the house in 1999, Mitchell E. Bean, the interim director of the House Fiscal Agency at the time lays it all out in black and white! Notice the beautiful language of business, words used like “revenue”, “grants”, “interest” as in, their own interests. This is the language of the managerial class, the police state, your overlords and the ruling class of “the power elite“.

The process of distributing traffic citation revenue in Michigan is complex. Libraries, local units of government, court funding units, retirement systems, state departments, and a variety of programs providing grants to law enforcement agencies are all recipients of revenue generated by traffic citations. Each recipient of the revenue has an interest in the distribution process.

Memo to the State House of Representatives, 1999

It is in the best interest of the police state which includes the court system and the state legislatures to continue practices of nickel-and-diming its citizens through new ticketable offenses. Ticketing is a large revenue source on top of their tax payer funded base but, is not a good look so they look for ways to fund initiatives while shifting attention away by taxing things like liquor instead. In my mind, this activity is rife with conflicts of interest. There are times, most of the time really, when I drive around the state and I see a state trooper hanging out of their SUV doorways with a radar speed gun. It is reminiscent of a “hall monitor“. It is just one way how law enforcement work and operate. The police state absolutely loves miscellaneous traffic violations like speeding, a broken tail light, not using a turn signal, a loud exhaust, rolling past a stop sign, tinted windows that are a titch too dark, etc. It gives them the opportunity to pull you over and ask questions. “Do you have any large sums of money or drugs in the car?” Yes officer, I’m loaded up with money and drugs come on in! By the way sir or ma’am, I also have a warrant out for my arrest! I heard a statistic, I fail to find it, that something like 80% of all arrests are a result from a traffic violation stop and is a useful tool for “law enforcement”. Of course it is useful, duh, Mitchell Bean clearly said so!. That statistic may be true, perhaps 80% of traffic violations do lead to arrests. Either way, I am inclined to think it is on the high end of the scale because of how active I see police being, particularly state troopers, on our highways and byways. I see them quite active in poorer neighborhoods also, although, as Elizabeth Hinton lays out in her book, these poorer neighborhoods are usually majority minority. I would prefer a three strikes you are fined rule. For example, if you have a busted tail light, no turn signal, perhaps the bulb burned out, you roll past a stop sign, etc that the officer gives you a warning without a bunch of intrusive questions. It is logged into the system and if you violate two more times in a year, you then get a ticket on your third instance. This seams reasonable and fair. The state should not penalize citizen for violations as a mechanism of wealth extraction to enrich judges retirement funds or police retirement funds. That type of behavior and “interest”, is part of a self sustaining police state interested in revenue growth. Officers should not be hall monitors, they should be present but not “active” hanging out of their windows waiting for an obscure speeder in a speed trap zone only to interrogate them during the stop.

The current policing structure in Michigan is one of cat and mouse, many times, in my view, illegal search and seizure, perhaps intimidation and of course, para-militarization. The court system, an arm of the surveillance state, extracts money from court fees and fines as well. Prosecutors are more interested in prison sentences, fines and fees than truth leveraging fear tactics of harsher punishments so they can get plea deals also known as plea bargains where the accused bargains down their punishment to a lessor offense. I saw a crazy statistic about plea deals with an estimated 90-95% incarceration rate based on a plea deal. This rate has not changed in a decade (2011 – 2022) and therefore, nothing has changed. If you are interested in changing this part of the police state, voting in another duopoly candidate will not get the job done. This is not justice. As citizens we publicly fund our own oppressors and perpetuate it by allowing that system to maintain the corrupt conflict of interest that more arrests, fines, or seizures means more money for themselves and more retirement off the backs of every day citizens. In this instance, the tax you pay for “public safety” is a double tax and depending on your perspective, a triple tax with compounding interest! If you get a moving violation, your insurance rates will increase unless you complete a traffic safety course. Another stick whacking you over the head by the state. If you do not attend or you refuse to take the mandated course, your violation is reported to your insurance company. The result, insurance rate increases! This is also a form of a tax in my view, because, even though you are probably a good driver who slipped up and were caught, you are now forced to take a class or pay more in insurance. It is either an unnecessary tax on your time or your wallet. It is in the best interest of the state or locality to aggressively enforce or to make additional ordinances for you to violate which then drives revenue! In business there are mechanisms know as “drivers“. Drivers are things like ordinances and fines which then “drive” revenue. The more fineable ordinances, the more fines, the more revenue. There are also “price increases”. For example, the fine for a seat belt violation back in 2000 was $50 and in 2020 it is now $65. The business model and capitalism is alive and well in the police state! What I am describing is the tip of the conflict of interest iceberg with a massive police state underneath you often do not see.

Final Thoughts

I wrote this essay not as a dissertation of taxes as theft to shore up typical Libertarian tropes but rather as a way to show the average person how to think about taxation in new ways. Taxation can be the cost of doing business as a citizen in society but at some point the cost of doing business can become too costly! That governments can use corporations, public one’s you might trust like a utility or private ones like your phone or Internet company, as a means to tax or extract wealth in addition to the police state or other government infrastructure. Tax death by a thousand cuts distributes the pain you feel in paying these taxes as a neo-feudal serf in the field known as the local economy or the larger U.S. economy and how you become a commodity. The country, the state, your county and local jurisdictions are run like revenue generating businesses, these are your “land lords” in a feudal society whom you work for. You slowly bleed through a series of consumptive taxes, fees, fines, and other legislative initiatives meant to make you not see or directly feel the pain. The political elite spend your financial capacity through monetary debasement or deficit spending paying interest to bond holders transferring your wealth creating opportunity, to save money and invest it on your own, moving it in the form of taxation upward to the upper class. FICA is taken from your paycheck, you likely only see what is deposited into your bank account and move on hoping to get that big refund at tax time. Perhaps your property tax is rolled into your “house payment” or mortgage, again, further hiding what your property taxes actually cost because they are in escrow by your bank. You do not directly feel these cuts but you know they are there. You feel the pain indirectly. In the natural world, death by a thousand cuts is a type of behavior employed by leeches and parasites sapping you of energy but not enough to kill you! Not only is taxation a problem, so are the budgets they fund and the schemes by which they work because they are designed to be hidden or “baked in”. The resources we should have to provide things like good roads, education, health care or housing exist but they are simply squandered into the ether of inefficient government and conflicts of interests that become increasingly oppressive. Things like “fix the damn roads” becomes an actual plank driving a political candidate into the governors office. People should be shaking their damn heads at the absurdity that we should not by default, expect decent roads. Taxation largely benefits the upper class as they can legally use tax avoidance strategies, employ the help of tax accountants or tax lawyers to legally avoid paying “their fair share” while also buying politicians to poke holes into the tax code in their favor. The lower class has potential criminal liability put upon them for their tax avoidance schemes and by operating outside of the legal taxation system.

The State of Michigan in particular needs to reallocate resources to first pay off debt which saps financial power. This can be accomplished by stream lining inefficient pieces of government. Much of these inefficiencies lies within the police state which includes police, courts and prisons. The federal budget is an entirely different matter and one I would discuss if ever given an opportunity to represent the state at the national level. Because of how the U.S. dollar “works” in the world, the world actually needs more dollars to work properly since the dollar is currently the form of liquidity to make the global economy work. Libertarians decry the Federal Reserves money printing but the issue in global economics is far more complex. The state however, does not have the luxury to “print money” and financial debt is a serious matter. Debt, in terms of the states coffers, is a liability, not an asset.

Citizens, voters, politicians, leaders, all need the courage to discover what is broken. We need to think and stop shallow virtue signalling, stop the pandering, take part in deep dives to understand oppressive behaviors of the state so you and they can create the necessary change needed. Taxation funds government but should not be a burden around the neck of its citizens. Consider supporting a rational Libertarian candidate who could potentially drive change in Lansing on your behalf concerning this important matter.