Author: Rafael Wolf | Libertarian Candidate, Michigan House of Representatives

Editor: TBD

College, also known as “higher education”, is the heavily promoted and marketed hope of the lower and middle classes to attain a brighter future of high net worth, societal status or “the good life“. As Robin Leach once said on Lifestyles of the Rich and Famous, “Champagne wishes and caviar dreams”! When consuming media we often hear things like, “Studies show…”, and they continue, that people with college diplomas make x amount more, usually in the millions, over a lifetime, than those with only a high school diploma. These studies and those who promote them publicly shame anyone without a college degree. This is of course primarily because the United States has a culture that implicitly conveys money is success and a college education is the primary vehicle.

Adults with a bachelor’s degree earn an average of $2.8 million during their careers, $1.2 million more than the median for workers with a high school diploma.

Forbes: New Study: College Degree Carries Big Earnings Premium, But Other Factors Matter Too

These types of “studies” are dubious for a number of reasons in my view. Many studies use averages rather than a median. Surprisingly, the Georgetown study in this referenced article called “The College Payoff” does use median but only references another important metric, the time value of money or relative value of money, in their final numbers. These concepts show that a dollar’s value in the past or future is worth less or more depending on financial variables like inflation or what you may have invested in to get a better future yield. Dollar value today is not what dollar value was or might be.

Medians rather than averages are preferred because it is simply a better statistical methodology to smooth out data sets that contain extreme values. Someone once said, there are lies, damned lies, and statistics. Using averages rather than medians skews the statistical data, usually in unrealistic ways but, as noted in the methodology section of that published article, not using the time value of money or relative value is also a mistake they chose to make.

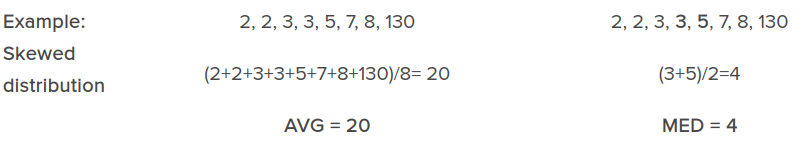

When calculating an average (AVG), a large number, as noted in the example below, can skew the number distribution or give a far larger average number than all the other numbers would reasonably be comprised of. The number result of 20, the average (AVG), is far higher by almost a factor of two, than any other number except for the outlier (130) thus skewing the resulting number distribution. The median calculation however, with the number of just 4 (MED), smooths out that “average” number to a more realistic value discarding the high values influence on the reality that most numbers are lower.

What you get then, with studies showing the value of higher education using average number datasets or those not using the aforementioned tools, time value of money (TVM) and relative value (RVM), which we discuss further soon, is skewed and unrealistic information. These types of data results can now be used as a recruiting tool in marketing materials that build a specific narrative about higher educations value during a lifetime of work. Educational institutions market to would be students who have future hopes and dreams of financial freedom and higher incomes promised by following the presented formula. Go to school, pay large sums of money for tuition often taking on debt, get good grades, maybe, get the degree, maybe, and get more money throughout your life, maybe. College then has become a means to and end. The “end” is wealth building, job security or whatever else your goal might be that comes with a higher income earner. It is yet another hybrid Ponzi bait and switch like scheme built on top of the backs of students using falsified data sets which basically promise a formulaic outcome. Going to college is the “new American dream” emancipating you from a life of potential poverty and struggle.

Elon Musk, an immigrant from South Africa and founder of many companies, not just SpaceX and Tesla, is worth ~$209 billion dollars as of September 2022. He is a college grad and the wealthiest person in the world. He is almost twice as wealthy as the two non-college educated billionaires in the top ten. Elon Musk has a college degree from a private school, the University of Pennsylvania (BA, BS). Of the top ten wealthiest people in the world, only Bill Gates the founder of Microsoft, worth about $129 billion and Larry Ellison co-founder of Oracle, worth about $106 billion, do not have college degrees. The number of non-college educated wealthy people is higher than you may think. When using “averages”, like in our prior math example, the numbers in lifetime wage and income studies get dubious if they include outliers like Elon or Bill in the mix of income data. When calculating average lifetime wages for non-college degree people, Bill and Larry are the number 130 as are Elon and other top billionaires to the college degree crowd. When researchers do not adjust the value of a dollar during the lifetime of a worker, the number is skewed yet further. Not using these types of techniques make whatever reported value questionable and any study not using median values with relative value of money simply unreliable.

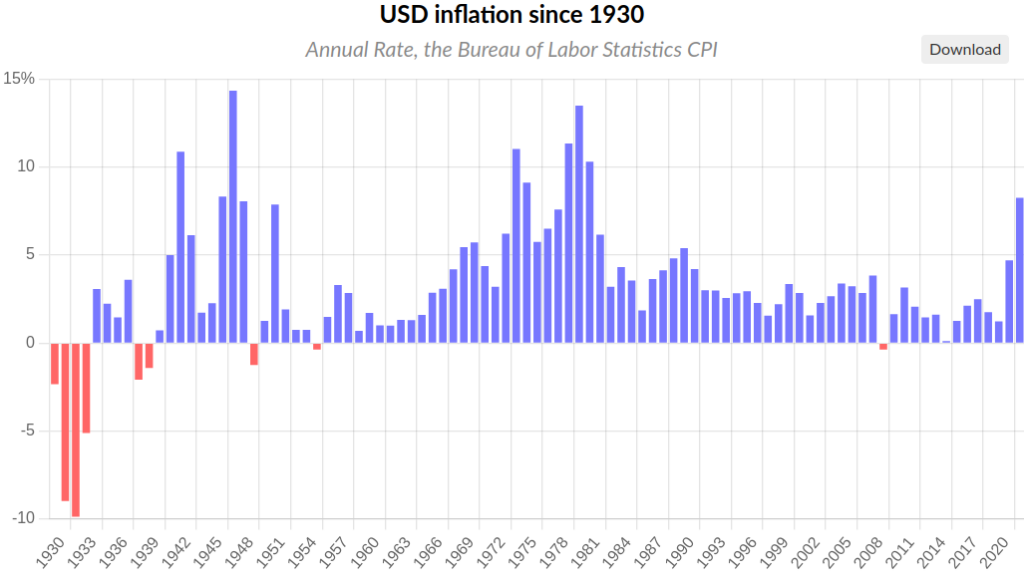

In the defense of these studies, trying to figure out lifetime earnings in a dynamic economy with both negative and positive inflation data over decades is akin to threading the needle on a Hail Marry touchdown pass after the clock runs out. I get it, this is tough work with lots of mathematical variables and I am by no means a trained statistician. In addition to the statistical technique, this particular study only studied individuals from age 25 – 64 who work full-time and in a full year. I know plenty of people that work into their 70’s or beyond and I also know many young people who worked as young teens. They are using the age of 25, since you can probably assume many have graduated college with a bachelors degree but someone like myself, who worked full time through my college years, did not graduate until I was about 28 years old. I started and stopped working or worked one or more part-time jobs too accumulating earned income during this time including bouts of unemployment. Because this study does not include data from full lifetimes, I view it with further suspicion. Not including “time value of money“, “net present value” or “relative value” in my view is the deal breaker considering rampant inflation, price hikes or money devaluation throughout history which can affect these totals relative value in today’s terms. Using things like relative value of money, as we will see, helps equalize the data so you can compare apples to apples in today’s terms. The study is useful and interesting but not, in my view, anywhere near accurate as a result relegating it to the public relations and marketing hype bin of information.

Like most “studies”, it attempts to build a narrative and tell a story for people to believe which is the ultimate goal here. They use data and make it fit a desired result. The built and heavily promoted narrative is then pushed into the public contentiousness by publishing studies reported on by news outlets, and used as a marketing tool for student recruitment. These studies are seemingly never questioned by the establishment or those who consume this type of content. Politicians funding education is the next best thing to kissing babies since kissing babies in our current era seems kind of creepy. Politicians absolutely love “funding” education with ever more dollars with no net uptick in end result, like more literate students. This basically means that the public pays more to get the same result and politicians do so on your behalf because a certain percentage of Americans vote the politicians into office.

Brief College History (Cliff-notes+ version!)

Lets put a few hundred years of higher education into some context. In the 1600 and 1700 hundreds religious institutions and governments mostly dominated by religious culture founded colleges and universities modeled after English schools like Oxford (link). These institutions were funded by gifts, endowments or taxes on things like tobacco. They trained ministers, lawyers, politicians, and the businessmen of their day. Discipline at these institutions could be brutal including things like public whippings. Public whippings! It reminds me of Dead Poets Society and how they would punish unruly students with a paddleboard spanking. Surprisingly and sadly, it might be making a comeback with written permission of guardians or parents.

Fast forwarding to “westward expansion”, we find more colleges and universities founded in the 1800’s. What are know as “land grant schools” were setup in a number of regions by the federal government. Michigan State University is one of those schools land granted in 1862. The first “HBCU’s” (Historically Black College or University) were also granted around this time. In 1994, Saginaw Chippewa Tribal College in Mount Pleasant, Michigan became another land grant school! Students in the 1800’s were taught “…Greek, Latin, geometry, ancient history, logic, ethics and rhetoric, with few discussions and no lab sessions.” This was an era of discipline and rigor, with a focus on education, not athletics or frat parties. Good luck finding rock climbing walls, workout facilities or amenities contemporary students compare against institutions to make their decisions these days. Rounding out the 1800’s (the 19th century) many schools began transitioning to German research university models and expanding enrollment into more areas of study.

Lets also remember, these institutions have business models. During this time, the idea of “upward mobility” enters the public consciousness as many institutions helped train rural agriculturally raised young people to do more urban occupations as the nation continued transforming itself from an agrarian economy (farming) into an industrial one (factory). The idea of upward mobility is still with the American spirit today, however ethereal in practical terms it may be. Here and at this time, we see educational market competition begin to change higher educational dynamics where schools compete against other schools for students. Some institutions choose catering to the wealthy while others choose directions catering to broader social classes training them for a new economy. There is a difference of quality not quantity for some while others focus on volume and raw numbers.

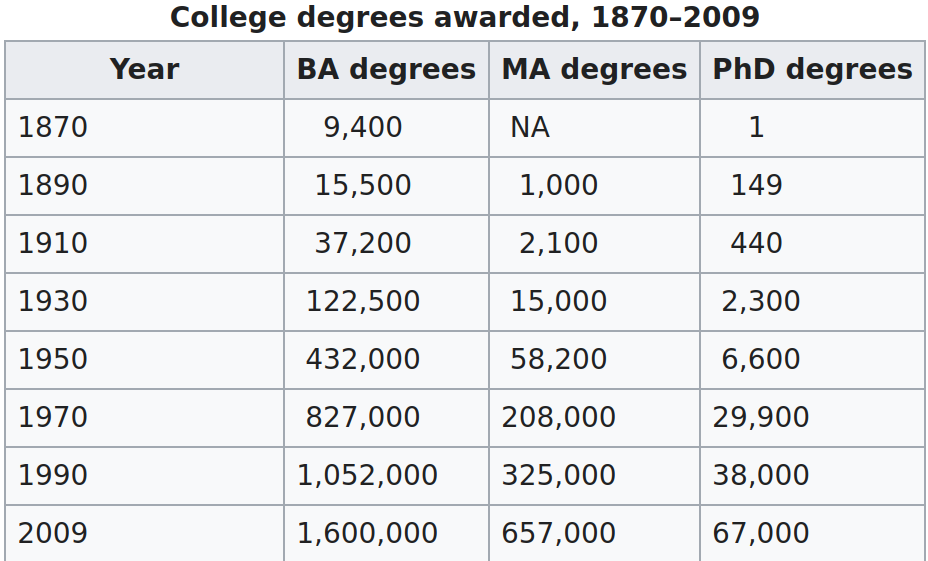

At this point, in the beginning of the 20th century (1900), we find less than 1000 higher educational institutions with less than 160,000 students total in the United States. Remember, the United States only has 45 states at the beginning of the 20th century. From the beginning of the 20th century you see “explosive growth” in student populations. State universities that had a student body of about 1000 grow to campuses bulging with 40,000 or more students offering broader curriculum. The marketplace of education economically expands. These institutions also grew regionally with things like satellite schools or campuses in other areas of the state to better serve their population and to serve the market demand. Part of this demand was the establishment of “teacher’s colleges”. As noted in another essay, The Straight Dope on Education, Western Michigan University was one of these institutions known then as a “normal school” founded in 1903. Look at the number of college degrees awarded during this time and the growth of such awards which further put things into context.

In the 1920’s you see the establishment and rise of junior colleges which later become community colleges. The great depression in 1929 affected the balance sheets of many colleges and universities in extremely negative ways. Every institution was threatened as enrollment, and thus revenue, dipped even if only slightly. This is where thinking about things in terms of a “business model” comes in handy. The business model at this point is a mix of public funding (taxation), large donor bases, tuition revenue and endowments. Institutions are always looking for ways to increase revenue. As we learn from Alexander Zaitchik in the book Owning The Sun, around this time there is a battle for copyright, intellectual property and patent protections brewing that would not only boost profitability for new discoveries coming out of research schools, but help to give them market monopolies and thus profitable revenue streams outside their traditional channels. This historical aspect of colleges and universities is rarely spoken about when discussing this period of time but it should be mentioned. Much of the funding for research is without a guarantee of outcome and therefore would be “risky” for any private investor to pursue just as it is today. What if the public, the collective society of you and me, funded risky research but the profits become privatized? Genius! Use of public funding to profit private corporations like this began to take shape during this time and public educational institutions are part of that evolution and has a complicated history that book discusses.

The GI Bill

In my view, this takes us to a pivotal moment in the history of education, and the United States post WWII (1946 forward). The GI Bill. This moment in history demonstrates how government intervention into relatively free markets can dovetail or spill over into other aspects of an economy or system which were not necessarily the intended target resulting in what some call “knock-on effects“. Knock-on effects can have unintended consequences, for better or for worse. They effect the way things might naturally function had there been no market manipulation on the part of government or other outside forces. Intervening policy like the GI Bill, free money to veterans for higher education, develops odd knock-on-effects and begins getting interwoven to bolster the military industrial complex and the rest of the economy. Yes, you read that correctly, the rest of the economy. The GI Bill becomes a benefit of being in the military for a set of citizens in a certain social class affording them opportunity they might not otherwise have. It becomes a recruitment tool which appeals to those who can not afford higher education. The “non-officer class” now has opportunity to attend a place of higher learning, if they can survive. This is partially, although not widely discussed in public circles, why you see “free college tuition” schemes poo poo’d by some politicians while others applaud the scheme advocating for it publicly while functionally, doing very little to usher it in. Not many speak against the GI Bill but it is a subtle tool of the military industrial complex that preys upon a particular social class. Some would suggest, it is not preying on a lower social class at all but rather, it gives them opportunity! Both statements here can be true.

The Biden administration recently threw a few crumbs to those with government student loan debt as did the Trump administration in 2019. The $330 – $390 billion dollars the Biden administration has “forgiven” is nothing in the grand scheme of anyone’s budget because future borrowers will simply be burdened paying higher interest on their loans for the give away of present discounts. Most critics of the Biden student loan debt forgiveness program, which is still being debated in 2022, frame it as a burden to the tax payer but it is not. It is debt being put onto future borrowers at higher rates of interest that will make this program “whole” although the program is still being fought over in the courts. Like most “solutions” from duopoly politicians, the model that works is kicking the can down the road and burdening the future with past and present debt or debt forgiveness. Duopoly establishment candidates, if they think for a moment, know that free college tuition would disincentivize tens of thousands of military recruits annually who see the GI Bill as a carrot incentive that presses them into military service. These potential recruits might not otherwise join the military if it were not for the GI Bill. Free tuition outside of the GI Bill model would all but destroy the college carrot the military now offers to potential recruits. Also, at the start of the GI Bill, it not only affected colleges and universities with hopes of “guaranteed revenue” from Uncle Sam who were expanding programs like this but it began affecting influence that the military has in society. It did so by setting up a plank of the military industrial complex which further embedded it into the economy and into the public consciousness as a “good thing for our veterans”. It breeds a pro-military public mantra resulting in cult like “hero worship” of the veteran class, the military and the thinking that if you do not also worship our heroes of battle, that you are an unpatriotic Communist sympathizer.

The GI Bill, not necessarily a bad program in my view at this time and in its historical context, paid for veterans of wars to attend colleges or universities which included their tuition and living expenses. It covered 50-80% of the total cost. As noted, higher educational institutions would begin competing for these sources of “guaranteed money” which lead to a number of scandals in later years. The GI Bill created unusual market demand for propaganda (marketing) that targeted GI’s luring them into institutions to bolster revenues. In part, it was the kind of marketing propaganda like the one at the beginning of this essay which references voodoo mathematics promising a lifetime of higher returns vis-à-vis a higher education. Post WWII, we being to see the beginning of a growing “war economy“. We are a nation of war, then and now. As a nation we engaged in the Korean war, Vietnam war, The Bay of Pigs invasion (Cuba), Grenada, Panama, Persian Gulf war, intervention in Bosnia and Herzegovina, invasion of Afghanistan, invasion of Iraq (twice), War in Northwest Pakistan, and the list goes on even today in 2022 with a U.S. and NATO proxy war in the Ukraine (timeline link).

Moving forward to the 1970’s, the United States has been able to deficit war spend which enables it to annually increase the military budget regardless of economic condition (about 5% annually). Do you remember how the United States used to pay for wars? They would take out loans from war financiers, other governments or try and sell “war bonds” also known as “victory bonds” to its population. Often, political leadership had to convince the populous to support a war effort. Post WWII, through a number of both Republican and Democratic administrations, they built the American economy with an increased dependency on the war machine for economic growth or to spur it out of an economic recession. The duopoly not only built and funded the industry of war but leveraged the military against other nation states as a tool of Empire. Since its founding, America was building an Empire and today, we maintain it partially with our military. Greater amounts of funding, sometimes less depending on administration, are allocated to meet the demand from veterans desiring to take advantage of the GI Bill and is interwoven into the annual federal budget.

Wars are financed with debt, wars are fought by troops, veterans of those wars are then funded with money for education and by proxy, educational institutions are also partially funded which has positive compounding economic effects. Prior to the 1970’s when gold was not decoupled from the value of the dollar, the spending on the GI Bill was not “deficit spending” as such. The U.S. actually had the money to pay for these programs at that time. By 1956, 8 million WWII veterans used GI Bill funding to attend colleges and universities which fueled economic growth in the education sector and strengthened the labor force of the middle class.

Something to keep in mind as we move on here in our narrative is that, post WWII, the economy drove education and student lending programs. The economy soaked up new workers like a sponge and was hungry for educated labor.

Shifting from the GI Bill, what it was and kind of how it works, let us look at college tuition so we can better understand how that piece works. The GI Bill pays tuition, room, books and board so it is important to understand a few details. Most people I know continually complain about the high cost of education so this, again, is important for us to understand. Why does college cost so much?

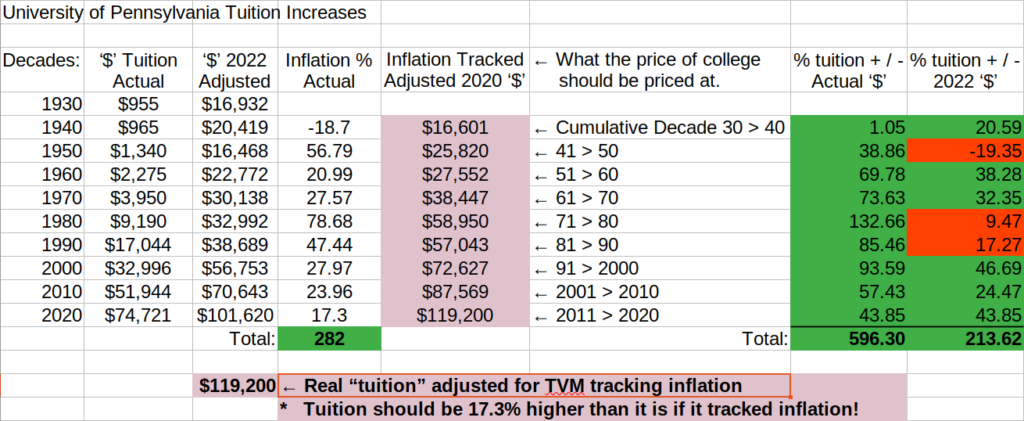

It is difficult to find statistics on tuition prior to 1970 but I found one interesting data set from the University of Pennsylvania, Elon Musk’s alma mater whom we mentioned earlier in this essay. The University of Pennsylvania is a “private university”, not “public” so the dollar amounts are higher in these examples than from public institutions. The lesson learned is still the same.

In 1930, undergraduate tuition was $400 dollars. Room and board was $520 with textbooks costing around $35 dollars. In today’s money (relative value of money), $955 dollars ($400 + $520 + $35) is equivalent to $16,932, again, in today’s terms (2022). In 1940, just 10 years on, tuition was still the same in “real dollars” with a mere $10 increase in books (link) raising tuition in today’s terms to $20,419 (2022). Here is the $3800 dollar question! Wait, why, if tuition is still relatively the same in “real dollars” at about $965 dollars, is the actual dollar amount of $965 in 1940 priced in today’s dollar value about a $3800 dollar increase? How can $10 dollars represent $3800 dollars? That makes no sense!

Great questions dear reader! This is why studies not factoring in things like the relative value of money, are severely flawed. From 1930 to 1933 the nation experienced a bout of “deflation” as a result of the great depression and during the decade, this particular institution did not also deflate or discount tuition. They kept prices the same at about $965 dollars “all in” on tuition, books, room and board. Thus, they quietly increased tuition on all new and existing students by not discounting tuition while the economy around it was discounting (deflating)! Economic deflation is not the economic norm in American history. The most recent spate of deflation was in 2008-2009 with the “global financial crisis“. By not decreasing tuition in an economic environment where other things were getting cheaper, the cost of education became more expensive as a result, about $3800 dollars more expensive in today’s terms but only $10 in real terms. This is an important concept to wrap your head around and to understand. An institution could maintain their profit margins and because of the economic conditions, do things like deflate salaries or benefits while maintaining an inflated tuition price to improve margin. Genius! That is a sound business practice! They could thus maintain the financial health of their institutions while putting a greater burden onto the student body to essentially pay more and faculty or staff to sacrifice more. On its face, in real terms of just $10, it seems like tuition did not rise in a decade, but it clearly did in relative terms! You must understand how real and relative value operate in a historical context to normalize your viewpoint comparing apples to apples as they say. This also shows how the price of college or university, even in 1930 to 1940 is largely “inelastic“, unaffected by increases in demand or a lack or demand. More on this shortly.

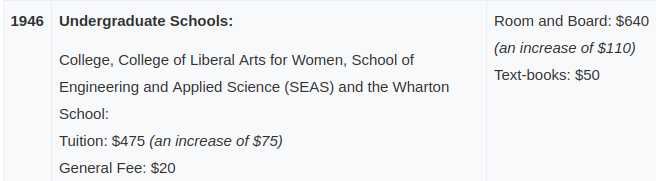

By 1946, just two years after the GI Bill was passed what might you think happened to tuition, room, board and books? All that easy GI Bill money was dumped onto the market right? In 1940, the price was $965.

We see a significant increase across the board! But wait…you might be thinking it was a result of the GI Bill and “guaranteed money” from “the gubment” because clearly that is why the price spiked, because it created a surge in demand. I threw that tidbit in there to get you thinking about any “bias” you may have about Libertarian economic dogma. I can hear some readers thinking “Here we go, another Libertarian complaining about government hand outs to special classes blaming tuition increases on government policy”. I have heard this argument by Republicans and conservatives, that “free money” or easy access to money, like loans, will drive the costs of college tuition up because it increases demand. Well…that is a perspective is it not? Let us see if these assumptions are correct shall we?

Here we see an increase of $75 for tuition and $110 for books which looks evil and bad on its face right? This is actually a perfect example that correlation is not causation! Sorry Republicans or those who hold the aforementioned view! Price increases are NOT always a result of free money or access to loans. The context matters as does an understanding of what the price of college is.

In relative value of money terms the amount equivalent in today’s money, tuition after the “increase” is just $19,164 (link)! Tuition then at this time, in today’s terms went DOWN from the previous five years ($20,419 in 1940 see below excel chart) not UP even though there was a significant increase in real dollar value at that time. No, no dear reader, tuition, although it went up in real terms then did not actually go up in relative terms! Is that hard for you to wrap your head around? Time is an interesting old man! This is where and why things get complicated and messy. Breaking these things down is a difficult task and takes a lot of effort to frame up a proper understanding. After WWII we see “price controls” and other government policy get lifted. These policy changes unleashes inflationary pressure into the economy. Yes, the United States has a history of government price controls. Inflation begins to take hold and prices rise for decades, much like they are today as a result of a number of government policies, supply chain problems, resource constraints, quantitative easing or monetary tightening, etc. The GI Bill was not what moved the needle on the price of tuition! Here below is a list of tuition rates from the University of Pennsylvania’s data set in a chart I have made that you can download. What we learn here is that the GI Bill had very little to do with tuition increases and what all businesses were fighting, including colleges and universities, was inflation and the value of the U.S. dollar! Sound familiar? We continue this battle even today.

Notice below the “$ Tuition Actual” and the “$ 2022 Adjusted”. The 2022 Adjusted is the Relative Value of Money value which is what tuition would cost in today’s money so we can better understand what $955 “means” ($16,932 in 1930). I also noted, in purple, what tuition should be if tuition tracked inflation all the way until 2020. What you find over 90 years is that inflation was a total of 282% in the overall economy. Tuition in raw dollar values (% tuition + / – Actual $) is double the inflation number but if you adjust for Relative Value of Money, it is less than actual inflation at just 213.62%. Educational institutions like the University of Pennsylvania could not increase tuition at the rate of inflation over time and so they have actually been, during some years, far behind inflation like in the 1980 row. In the 1980 row, this includes 1970’s inflation from 1971 > 1980, 78.68% inflation over a decade and, adjusted for Relative Value of Money, they were only able to raise tuition in relative terms at 9.47%. If you look at “‘$’ Tuition Actual” inflation of tuition looks like 132%, wow what an increase! It was not as bad as it looks however when you factor in relative value of money. After 90 years, tuition at this particular institution should be 17.3% higher than it is in 2020! Their tuition in 2020, again, adjusted for relative value of money, was about $74,000, $101,000 in today’s terms and had they tracked inflation, tuition should actually be $119,000.

What we see then from the data above which I have painstakingly compiled with the help from previously referred links, is that decade after decade educational institutions have been doing a number of things just to keep up with inflation. It is not factors like “free tuition” or government education programs that pressure price increases. It’s inflation, its the economy stupid! Ironically, in relative money value terms, any price increase from institutions quite often do note keep up with a devaluation of the dollar and inflation often losing money or monetary power. From 1930 – 1940 they were able to raise the real value of tuition thus “making money” but from 1940 – 1950 they lost previously gained ground due to a decade of high inflation. The cumulative inflation decade after decade is absolutely out of control with inflation in the 1970’s to the 1980’s represented in the 1980’s box of 78.68%. The decade of the 70’s goes absolutely bonkers year over year. During this time, in the 1970’s, educational institutions got hammered and only cumulatively raised prices 9% at the University of Pennsylvania when you factor in the relative value of money and what the dollar is “worth” in today’s terms. To any business in existence during this decade, inflation is a massive set back in real income, revenue, and profitability if they are unable to raise prices to keep up with inflationary pressure. In the context of this data, colleges and universities look less greedy than most media outlet narratives present because their analysis is poorly done not using things like the relative value of money.

Unlike many politicians who revel in vilifying these institutions as price gougers or irresponsible vultures, I would rather understand a broader context with all the facts and macro economic data presented in time adjusted terms. Politicians both praise and demonize out of both sides of their mouths depending on political expediency.

This approach gives a broader and more accurate understanding of how things work. Data can be skewed to fit a narrative that drives political will and what the public will allow a politician to do or not do in terms of setting policy without public outrage. Favorable data outcomes shoring up preferred narratives that a college education can get you millions more of income over a lifetime of work are reported on by “reporters” and not “journalists” for the purpose of political gain or some other unknown goal by interested parties desiring higher freshmen body counts. Colleges and Universities are certainly not the value they once were per credit hour since about the 1950’s when, in the 1960’s, we begin seeing inflation go crazy and college tuition follow suit even though those institutions essentially lose money due to inflation with an inability to raise prices over decades to match. In 1950, college was a touch cheaper than it was in 1930 in adjusted time value of money terms due in large part to a strong dollar and strong middle class wage earners. If you look at what this particular institution did over the years you see the addition of fees like, technology fees, meal plan fees, room and board in “dorms” with ever more lavish accommodations in addition to things like “student activity fees”. You see the increase of non-tuition fees so an institution can cook the books if you will adding perceived value even though the value to their education is debatable. These institutions can claim their tuition is minimally increased while raising other non-tuition fees. In my calculation, I included these fees in the overall number which would be a total cost of education.

College tuition in relative terms against inflation with relative value of money factored in generally goes down and not up simply because these institutions are unable to raise tuition more than the rate of inflation. This assertion runs contrary to main stream narratives that you may have heard or read with respect to why college tuition costs rise. Cumulatively, in the 90 years of data presented from this one institution, in RVM terms, they have not kept up with inflation. College in 1960 cost $2,275 and now it costs $74,000. Yikes, those greedy bastards! No, we can not look at these numbers to suggest that tuition from 1960 has gone up 3200% or more, because this is not true! There are other factors here that we should mention. The “value” of a degree could be in question. If you glance back up to how many degrees are awarded annually, what you find is that more degrees are awarded annually as the number of students swell enrollment rolls. The supply is high and the value therefore relative to population totals of a degree becomes cheapened as a commodity that everyone has. If everyone has a degree, then nobody has a degree. An MBA from Western does not carry the same gravitas as an MBA from Columbia. There are many other knock-on effects affecting the perceived price of education like the diminishing power of an inflated dollar, high prices, deflation, incomes in any number of jobs that, like college tuition, can not keep up with decades of high inflation and therefore lose buying power. Things feel more expensive because they are and because you have less buying power in real terms not just relative terms. Much of the actual pain is because the working class has less power in every dollar earned and therefore college seems more expensive year over year. It is because most have less power in every dollar spent. It is a colleges ability to increase tuition vs your ability to get income increases to match which does not happen. Their ability to raise tuition outpaces your ability to raise your income and you annually fall further behind as the power of your dollar erodes. Your buying power as a consumer has been shrinking against some things while increasing against others which is what the Relative Value of Money and inflation over time teaches as a principal. Your buying power of an education is eroding while your buying power for a cheap laptop from China increases which is one reason why laptops get cheaper. The price of a laptop is also “elastic” vs that of the price of college which is “inelastic”.

In economic terms, when we look at that typically Republican idea about “demand drives price” because there’s a glut of free money and loans on the market, we find that the price of college is “inelastic“. Elasticity is an economic term where something like demand, or lack thereof, will affect price in positive or negative ways. More demand and less supply means higher price, or, less demand and more supply means lower price. Although this might work for Walmart and Target that are compelled to increase or decrease prices based on demand for goods on their shelves, this does not work for college and university pricing models. The goods on the shelves of retailers is “elastic”, price can both expand, and contract. Demand for an education does not affect price and therefore makes college tuition inelastic. The fact that students take on debt which is practically guaranteed under federal law, but was not always, does not impact price either and for a number of reasons. It is not affected by how many people attend because institutions such as Western Michigan University have a limited number of enrollment slots to fill with a portion of students getting rejected. Western Michigan University only accepts about 89% of their applicants. If these institutions wanted more revenue at higher prices, they could accept 100% of their applicants but they do not. If you review the information about the 1930’s to the 1940’s price of tuition noted previously for room and board at The University of Pennsylvania, you would notice these prices did not essentially change in 10 years. Prices stayed steady at $400 tuition + $520 room and board + $35 for books with only a $10 increase for those books…in a decade! Regardless of demand, which decreased during the depression, the price was the same and they did not, unlike Walmart or Target, as a result of lower demand, need to lower price. Prices stay the same or go higher because they can and with no affect from demand or supply. In the 2020 – 2021 academic year, Western Michigan University, in addition to Central Michigan University, kept tuition the same as the prior year (link). This was the year of COVID lock downs where institutions closed campuses, required vaccines and did remote learning in lieu of in class learning. Inflation was 1.4% in 2020 and 7% in 2021. “You gotta pay attention” (a quote from an unknown Western basketball fan)! They did not decrease tuition, just like they did not decrease tuition in 1930 – 1940.

Colleges and universities had a golden opportunity to increase the price of tuition but decided not to. If they needed to increase demand, why not discount tuition, aside from COVID lock downs of course? It is because people do not choose to attend a college or university, on average, because it is cheap. It is not like buying a typical consumer good with a Black Friday Sale. They choose to attend because of the sports team, the amenities, the location, the perceived future value of the degree and because of ancillary things outside of their instruction or degree programs. Many lie to themselves about the “good program”, as if they would know. If they do know it is usually because of US News and World Report that publishes their top schools for 2022 where they rank schools from worst to first. These rankings have been manipulated in a number of ways for years by these ranked institutions because they are meaningful public relations tools used in, you guessed it, marketing campaigns. The real reason someone chooses a school is probably a mix of the money making narrative in your lifetime, establishing a good life for yourself, the ancillary lifestyle experiences and possibly, cost or school ranking or perhaps, you are a sports fan. Many more students use cost as a factor deciding to “downgrade” into community colleges as cost saving measures. I am painting with a broad brush here. Institutions like Western and CMU that did not raise prices during this time, technically lost money and, as the MLive article explains, some cut salaries and compensation for certain executives by up to 10% to pay for it! This however, was short lived. What you just read about is exactly what happened, but for a longer duration during the Great Depression. Know your history.

Educational institutions like Western and CMU have additional sources of revenue. Remember, they have sports teams with ticket sales, grant funding from government institutions like the NIH, endowments, state funding from the tax payer, logo licensing with athletic wear, etc that shore up their institutions total budget. Research universities have a bit of an advantage vs non-research institutions and every institutions has a different revenue mix. No two colleges are the same. Tuition is just one component but the component everyone seems to beat up on when discussing college. Everyone seems to complain about price or tuition but not the cost of football tickets!

Enter “Student Aid”

There are many forms of “student aid” and it gets complicated with a number of formulas based on income, how long you have been in school, if you need a co-signer, what the variable interests rates are, etc. Loans, scholarships, and grants are a few aid options for those seeking higher education. Loans are an obvious form of debt burden unlike scholarships and grants. Calling a loan, “aid”, in my view is oxymoronic. It is like calling a credit card, financial aid when it is a financial boat anchor. Student loans have been in the news the past few years in part because of political pressure from a number of influential forces on former President Trump and now, put upon President Biden to forgive the burden of student loan debt on borrowers. The very parties, the Republican Party and the Democratic Party, that created the student loan scheme are being pressured to unravel it, good luck with that! We must once again keep our thinking on this matter in the larger macro concept that the U.S. “as a business model” run by businesses and politicians that act like business people. Up to 70% of college graduates have used student loans to pay for college expenses. Many intentionally over extend themselves taking out more than needed as a financial cushion in their daily lives. In the United States as of 2022, there are almost $2 trillion dollars owed in the form of student loan debt yielding the holder of said debt a guaranteed interest rate of return, often 4% or more into the 6.50% range currently and about 92% of the total outstanding student debt are federal loans. Student loans have been around since 1958 under a program passed by congress called the “National Defense Education Act“. It was a specific loan program for certain types of students with the “long title” of the Act, as they say, as:

“An Act to strengthen the national defense and to encourage and assist in the expansion and improvement of educational programs to meet critical national needs and for other purposes.”

From 1958 to 1962, the life of this bill, almost $1 billion dollars was spent on the program. Remember, RVM. $1 billion dollars in 1962 is almost $10 billion dollars today (link). What is interesting here is not that the U.S. invested almost $10 billion dollars on education, chump change really, but that they admit educational institutions at that time were “not up to speed” compared to our perceived rival, Russia and Russian (USSR) educational institutions. The bill was also defense oriented military spending, to combat or surpass perceived scientific achievements of the Russians. The NDEA was essentially the first “STEM” program (Science Technology Engineering Math) used to goose a lack luster education system that was not competitive in the world. Believe it or not, in the 20th century, the United States has historically been lazy and only needed to be competitive in the world when their rising position in it was threatened. If the United States was to continue gaining power in the world, under an American imperial model, then it needed scientific and technical capacity! It had recently been able to steal technical minds from Europe before, during, and after WWII in a technical brain drain. Post WWII, you saw market forces vying for technical talent because of increased competition with Russia, one of the only industrial powers left standing after most of the world had its industrial capacity bombed out. The U.S. needed more mathematicians, scientists and engineers. Private industry needed technical talent also as did educational institutions to teach these skills further exacerbating labor shortages in those areas that created a labor shortage feedback loop. After WWII the U.S. economy boomed because, as noted, it was one of only a few industrialized nations on the planet not to have their infrastructure decimated. This gave the U.S. about 50% of global industrial capacity and GDP after WWII.

What you see then, and remember this, economic demand drove education. It was starving for a well educated working class! Today, marketing drives education!

In 1965, “The Higher Education Act” was passed which allocated more money to higher educational institutions and offered potential students of all stripes student loans. This Act was subsequently reauthorized in 1968, 1972, 1976, 1980, 1986, 1992, 1998, and 2008. It was set to expire in 2013, but was then extended in 2014 and has been kicked around congress as the PROSPER Act. The first federally insured student loan was issued in 1967 by the Bank of North Dakota. This was essentially the genesis of the student loan program where students could borrow ever greater amounts of money for school tuition and other expenses at ever greater variable rates of interest.

Remember, under the U.S.’s business model, businesses, banks, bond holders and investors are the most important groups in our country garnering a watchful eye and protection from the political class. Businesses and their interests are important in the business model, not you, not workers and certainly not students. Goosing opportunity for students to get a higher education may have started out with good intentions, competing with another country and was the public facing narrative (propaganda), but what the student loan lending model becomes is an opportunity for money to be made with voluntary debt bondage! The model of lending essentially converts students, who have been heavily propagandized by marketing that promises high incomes and bright futures, into debt servants for decades. Some might say, yes but, these students entered willingly into a contract for a loan, they aren’t “slaves” or “serfs” or in debt bondage unwillingly. I personally consider most of this industry predatory and that, for the most part, these loans are predatory loans. Many students do not fully understand what they are signing, nor do their parents if they have to co-sign a loan under their name affording their child or children a future education with future job opportunities. With the knowledge that 50% of Americans can not read a book written at the 8th grade level, including those students, how can they possibly read an understand a loan agreement? When I attended school, I took out both subsidized and unsubsidized student loans. I remember my mother having to co-sign loans and I chose to make payments on these loans working my way through school because I understood what deferring payments would do to the overall balance. It was a hard push and my grades suffered as a result. I was probably a C student. A funny knock-on-effect is, that my diligent payments to the bank improved her credit score but not mine! I understood what the loans mean, what the payback terms were, what compounding interest means, opportunity costs, etc and I had fits and starts of attending school until I was able to apply for the loans because I always tried to pay it by myself but I could not. It is hard to live life and pay for school without the extra capital.

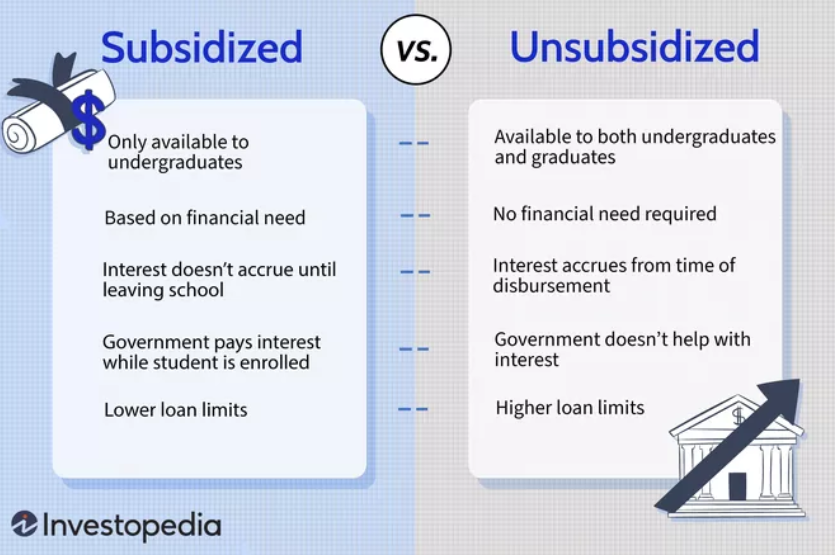

There are two types of federally funded student loans. Subsidized loans, based on financial need, where the federal government pays the interest, something like 1% while you are attending school and unsubsidized loans, with interest that accrues from the date of disbursement.

As the Investopedia article explains, there are limits to how much you can borrow, who pays interest or if it accrues while attending school. You can get both subsidized and unsubsidized loans, applying the maximum of the subsidized loan toward tuition and then the remaining balance, from the unsubsidized loan. This gives a borrower full tuition, if the tuition does not go over the maximum lending ability of the loan maximums and depending on their student status (first year, second year, etc). Students can pile up the debt owed from both federal borrowing and from private lenders in short order. These lending programs are designed to immediately put students “under water“. It is a lot like an underwater mortgage in which the value of the home is worth less than what is owed to the bank, the lender and thus, the borrower is underwater owing more to the bank than they could get with current market rates if sold. The students “market value” with no degree, is the same value as the high school graduate until of course, the student can graduate and get their college credentials. Sadly, a certain segment of the college population, almost 33%, never graduate and they find themselves underwater owing more than they can pay off because they can not command a higher pay scale without having acquired a college diploma. This type of lending structure is not aid at all and a system designed to tank the financial future of at least 1/3rd of all who attempt a degree program. These individuals, sadly, are debt serfs.

As of 2022, a subsidized loan rate is 4.99% APR and an unsubsidized loan rate was 6.54% APR. Over the life of a loan of $5500 dollars, as an example, because what you can and can not borrow depends on several factors, you may pay about $1000 dollars more in interest from the two loans with a 20 year pay back term. This is just an example to show how the different interest rates compare over a fixed term. This is also for one disbursement of $5500 dollars for an undergraduate. Of course, college costs far more than $5500 dollars for a year. Most students use both subsidized and unsubsidized loans to get them their total tuition dollar amount in addition to getting money from family or perhaps part-time or full-time work.

Some people reading this may say, but, as you stated earlier, President Joe Biden forgave a bunch of student loan debt and that’s awesome isn’t it? Trump also did if you recall but for a special category of student. If we put our thinking caps on and remember…that the U.S. operates as a business model, we can see what is taking place with these iterations of student debt cancellations. The model does not care about you, it cares about revenue, profits and protecting the business class like bankers or financiers bundling student loans into securities sold on the open market to the wealthy that want a yield or a rate of return on their investment. Trapped debt servants are a wonderful investment with guaranteed yield. In that light you can see student debt wasn’t forgiven, it was transferred forward to future borrowers as noted in the beginning of this piece!

Nobody in popular media is suggesting this is what took place, but it is what transpired from both Trump and Biden’s student debt forgiveness offerings, that is, if Biden’s offering makes it past the courts. The base system has not changed, interest is being charged for new borrowers and as that interest rate increases over time, any debt forgiveness will be made up by future profits at these higher interest rates. This is prescient. The current environment is one where the Federal Reserve is raising interest rates and eventually these bond holders will be made “whole” by having these future borrowers pay for what is forgiven today. The politicians, bankers, financiers, Wall Street, etc are dunking on future borrowers. This trick is often deployed by politicians who’s goal is to mask financial slight of hand trickery. They push any present pain forward, also known as kicking the can down the road onto those who will burden that pain. People in the future might not even realize how much pain they are experiencing because they only see a .25% increase in interest that they might not notice. A slight increase in interest rates that compound over time for future borrowers, blamed on the Federal Funds rate, Treasury rates, a poor economy, recession, inflation or whatever excuse they fabricate is simply an increased interest rate hike to pay for someone else’s present discount without systemically changing a bad system whereby private corporations and the state profit from a form of neo-serfdom, neo-feudalism and the debt servitude of college graduates. These students will work for a large portion of their lives paying this debt off. I did. I finally paid my debt off at age 43 I think it was, just a few years ago. I fell for the trick and it was no treat!

Brief Conclusion

There is a tradition in America to blow smoke up the public’s skirt with statistical data and thus, build a believable narrative to get the public onboard with what are potentially bad decisions that have unintended knock-on-effects. In this tradition, promises of upward mobility and the good life are made but are quite often illusions, mirages in the far off distance as you walk your path through the hot desert of life thirsty for the opportunity promised. Some make it to an oasis, and some do not. Governments in the U.S. are businesses and you are a commodity input. In the collective sum total of gross national product, you are a tick on the accounting ledger of a banker or an investment firm that can extract yield. You are an asset or a liability on the balance sheet. Systems like college and student loan schemes sponsored by government are there for others to profit now, not you. Student loans become “assets” by investors used as money making vehicles to get wealthier over time with compounding interest. If you asked for an “investor” from Japan, as an example, to buy a single student loan that bears interest over a term, they will likely say, I do not know this person. Who are they? Are they going to pay it back with consistency until the loan matures? Will I get my money back at interest? The investor is unlikely to take on the market risk to buy such debt and hold it from an individual person. The students liability is the investors interest yielding asset. What if however, we were able to bundle thousands or tens of thousands of these loans into a “product“, also known as an investment “security“? Would investors be interested in something called “SLABS” sold by big banking institutions and professional financiers? Indeed, that is what you find, that is what we have and that is why the system exists in the manner it does today. It makes the wealthy, wealthier. SLABS are known as “Student Loan Asset-Backed Securities” in which private student loans are bundled, securatized, rated and then sold to “institutional investors” is what the student loan industry is all about. Yes, the same institutions you may have your company 401-k retirement plan with invests in SLABS. This is how the housing market was exposed in 2008 – 2009 causing the “global financial crisis”. Banks would bundle sub-prime or sub-optimal loans into bundles, collateralize them, market them as a great investment vehicle and then sell them on the open market as investment products with a yield (interest). The same thing happens to your private student loans. This is also why politicians like Joe Biden, the current President of the United States, passed laws to disallow student debt write offs in a bankruptcy, because they are protecting the investor, not the student.

The vast majority of “education” in the United States is not about your education, your future or even how much money you will make. It has become a business model with a goal to maximize profits and make money in different ways with the promise of personal future returns driven by false advertising and marketing with bad data turning you, the borrower, into a debt serf. There are many other aspects about higher education not discussed in this essay like the university patent mills cranking out “research” on the public dime with funding from institutions like the NIH who then claim said “discoveries” for themselves. They create companies who’s profits flow back to the University coffers, often into “university foundations” which are shielded from transparency laws and kept private from the public’s prying eyes. They abuse, in my view, public funding from government institutions like the NIH (National Institute of Health) to find new medicines or treatments then privately copyright and often then license this knowledge for profit or build new companies with the help of the university legal departments to do so. Does the NIH or the public who fund the NIH get any benefit from these “investments”? Often not. The only benefit they get is access if their insurance can pay for it or they have enough money to self pay.

You will find that the notion of government student loans driving demand which in turn allows institutions to continually increase price is the myth. That is simply not why tuition continually increases. It increases simply because it can and is never decreased. This is the definition of an inelastic product or service as demonstrated in the 1930’s.

Continuing to vote for duopoly candidates will get you more of the same. They will continue to maintain these abusive system that push beguiled impressionable high school graduates into serfdom and financial bondage that legally, no bankruptcy can make go away thanks to duopoly establishment political parties that are in league with the banks against you. These systems oppress your personal prosperity with decades of debt servitude. It is questionable these young people can even read and interpret the legal agreements they are signing when 50% of Americans can not read a book written at the 8th grade level. The U.S.’s education system, in large part, graduates a highly illiterate population who are then preyed upon intellectually and financially.

Consider making real change by voting for a third party or independent candidate who is aware of these abuses and who might be able to unravel or unwind these systems. There can be a better way to invest in the future that does not make a serfdom class of debt slaves at high unfavorable rates of interest. We the people simply need the collective capacity to break bad habits of voting for candidates from the establishment. Consider voting for your Libertarian candidate or other third party candidates.